British company BAE Systems triples the turnover of the entire Spanish defense industry

- Distribution of business by sector in the Spanish defence industry

- Report on the economic and social impact of the defence, security, aeronautics and space industry

- Objectives of the Ministry of Industry and Defence for Spanish industry

- BAE Systems: a European giant outside the EU

- BAE Systems' competitive advantages

- BAE Systems' priority areas

- Naval business

- Cyber defence and intelligence

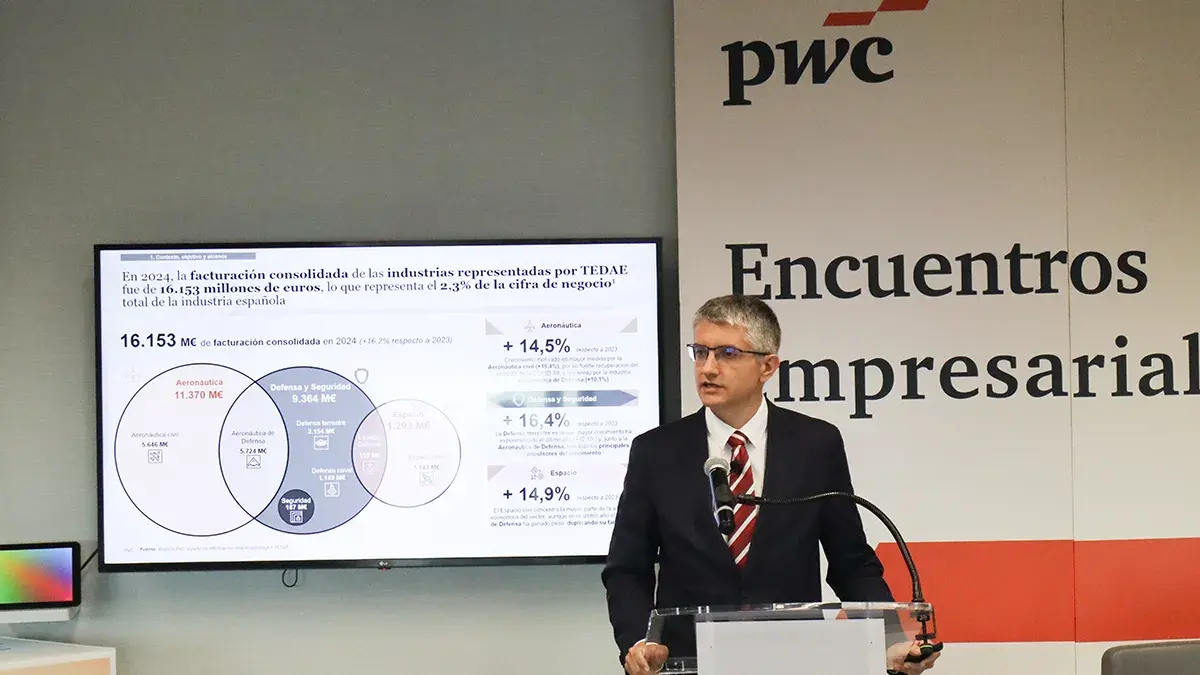

The wave of rearmament sweeping across the nations of the European Union and the rest of the world has been one of the main factors behind the increase in sales of Spanish defence and security products and services to €9.364 billion in the 2024 financial year, representing a 16.4% increase over 2023.

Distribution of business by sector in the Spanish defence industry

The lion's share of the €9.364 billion falls to the aeronautical business sector, whose turnover amounted to €5.724 billion (61.13%), followed at a distance by the land component, with €2.154 billion (23%), and the naval component, with €1.149 billion (12.27%). Of much less importance are sales of security technology focused on the defence sector, at only £187 million (2%), and the military space sector, which brings up the rear with £150 million (1.60%).

Exports amounted to 4.672 billion, almost half of the turnover, and their main destinations were France, Germany and the United Kingdom, nations with which the government and national industries are developing cooperation programmes such as the Airbus A400M military transport aircraft, the Eurofighter fighter jet and the future FCAS. The United Arab Emirates, Belgium, Canada, India, Kazakhstan, Norway, the Netherlands and Singapore have also been prominent customers.

Report on the economic and social impact of the defence, security, aeronautics and space industry

This is confirmed by the report ‘Economic and social impact of the Defence, Security, Aeronautics and Space Industry 2024’, an analysis document recently presented to the public and prepared by the consulting firm PricewaterhouseCoopers Business Advisors (PwC), based on information provided by TEDAE, the Spanish Association of Defence, Security, Aeronautics and Space Technology Companies, chaired by 75-year-old diplomat Ricardo Martí Fluxá.

With an investment in research, development and innovation (R&D&I) of €1.669 billion (17.8% of turnover) and a workforce of 43,190 people, the data collected in the report ‘shows strength and demonstrates commitment,’ Martí Fluxá points out.

At the helm of TEDAE since March 2020, he argues that the true value of the association he chairs is its ‘leverage effect’, as every euro invested by its member companies ‘multiplies its impact on the national economy, activates supply chains and opens up opportunities for SMEs and start-ups throughout the country’.

The Secretary of State for Industry, Jordi García Brustenga, stated in the presentation of the PwC report that his ministry's objective is to ‘bring’ industries and SMEs closer to the industrial fabric of defence, aeronautics, space and security and ‘to grow a new Spanish ecosystem’.

For his counterpart in Defence, Amparo Valcarce, these are four groups that have ‘consolidated themselves as fundamental pillars of the national economy’, placing Spain ‘in a position of relevance within the European and international framework’.

This supposed ‘position of relevance’ should be placed in the global context and, more specifically, within the framework of Europe. It so happens that the Old Continent's leading defence company, which rubs shoulders with the big corporations of the United States, is outside the EU.

It is the British giant BAE Systems, which in the 2024 financial year achieved a turnover of £28.3 billion – just over €32.55 billion – 3.5 times the sales of the entire Spanish defence industry, an unattainable goal for Spain.

BAE Systems: a European giant outside the EU

BAE Systems was founded in November 1999 with the backing of then Labour Prime Minister Tony Blair and two of his Defence Secretaries, George Robertson and Geoff Hoon. Twenty-five years ago, the three politicians recognised the advantages of bringing together the technological capabilities of a large number of companies, including British Aerospace and Marconi Electronic Systems, under a single organisation in order to compete in the international market led by large US corporations. In Spain, it is advisable to think very seriously about the pros and cons of creating a national champion in the defence industry and, moreover, politicising it.

Contrary to what one might think, BAE Systems' largest and main market is not the United Kingdom, which accounts for 26% of global sales. It is London's loyal partner and ally, the United States, which accounts for 44% of turnover. Other countries that are recipients of its exports are Saudi Arabia (10%) and Australia (4%), while 16% goes to European countries and the former British colonies in the Indo-Pacific and Africa.

The mega defence company claims to be one of the ‘most geographically diversified’, with factories, companies and business centres in more than 40 countries and a workforce of 107,400 as of 31 December 2024. Of its total workforce, 49,600 (46%) are located in the United Kingdom, while 36,200 (34%) are in the United States. If we relate the above data to sales, BAE Systems' productivity on the other side of the Atlantic is much higher than in the British Isles. Its employees in Saudi Arabia number 6,800 (6%), slightly more than in Australia, which has 6,300, while in the rest of the world there are 8,500 (8%).

BAE Systems' competitive advantages

This geographical distribution ‘gives us a significant competitive advantage,’ says its chief executive since July 2017, 54-year-old electrical engineer Charles Woodburn. A veteran of the oil industry, he was hired in 2016 as chief operating officer, with the approval of American (43%) and British (27.8%) investment funds, including BlackRock, the company that manages one of the world's largest securities portfolios.

Ranked year after year among the top seven aerospace and defence companies by turnover, BAE Systems is a manufacturing giant that combines high industrial and technological capabilities in a wide range of products and services for land, naval, air and space defence, cybersecurity and, across the board and as a priority, military electronics.

BAE Systems' priority areas

The mega-company focuses its activities on five priority areas. Firstly, ‘Electronic Systems’, with sales of around 8.5 billion euros, up 35% on 2023. Its factories in Great Britain and the United States are dedicated to the manufacture of command, control and communications systems, electronic warfare platforms, navigation, guidance, simulation and training equipment, electro-optical sensors, radars and much more.

The second most important area is ‘Platforms and Services’, which in 2024 had a turnover of around 5.2 billion euros (+15%). From the United Kingdom, the United States and Sweden – through BAE Systems Hägglunds – it manufactures explosives, ammunition, tracked and wheeled combat and logistics vehicles, howitzers and 155-millimetre self-propelled artillery.

Aircraft are its third cornerstone. In 2024, it achieved a turnover of close to 10.1 billion euros (+8%). It markets the Hawk training jet, is a privileged partner in the manufacture and support of the American F-35 fighter jet and, together with the Italian company Leonardo and the Japanese company Mitsubishi Heavy Industries, leads the Global Combat Air Programme (GCAP) new-generation fighter jet project, which competes with the German-French-Spanish FCAS to replace the Eurofighter, in service with the air forces of Germany, Saudi Arabia, Austria, Spain, Italy, Kuwait, Oman, Qatar and the United Kingdom.

Naval business

The naval business is also key for BAE Systems. Its turnover in 2024 is around 7.1 billion euros (+12%) with significant facilities in Australia and, of course, the United Kingdom.

Its current main activity is focused on the construction of six Type 45 destroyers, completing the manufacture of the last of the seven Astute-class nuclear-powered attack submarines and completing the programme of four large Dreadnought-class nuclear missile submarines at its shipyard in Barrow-in-Furness, in the county of Cumbria, in north-west England, both for the Royal Navy.

Cyber defence and intelligence

The Cyber Defence and Intelligence area added some 2.77 billion euros (+6%) to the Intelligence and Security business in the United States, while Digital Intelligence is located in the United Kingdom, both focused on cyber activities for the national security of the two countries.

In summary, in view of the data provided and the difference between vision and illusion, it is clear that any Spanish company, however much like Indra it may be and however many blessings it may receive from the Moncloa, is very, very far from even being halfway to becoming a European giant with the influence, technology and capabilities of BAE Systems. But, at least they are trying.