The Consequences of America's Historic Oil Collapse

Historic day on Monday. Something happened that had never happened before, the United States' crude oil traded in negative, causing astonishment among locals and foreigners alike. It is known that in order to find 'black gold' in the oil fields it is necessary to drill for it, but this time, where a huge hole has appeared, is in the negotiations for West Texas Intermediate, WTI Texas type oil, falling to negative figures. This represents the largest drop ever in a session and since futures prices first started to be traded in the 1980s of the last century.

April 20, 2020 will be remembered for the day in which WTI traded below zero dollars a barrel, an unusual situation that is explained by the adverse situation of the stock markets in the context of the current health crisis caused by the coronavirus pandemic, which has left tens of thousands of deaths and millions of people affected worldwide and has paralysed much of the economic activity; It has also affected the oil market, which is in free fall due to the drop in consumption caused by the interruption of almost all daily activities (there are no trips by car and the number of flights by plane has dropped considerably, for example).

No oil or derivatives such as gasoline are being consumed. Demand has dropped by 30% due to the coronavirus and has reached 1995 levels, all this despite the fact that American citizens are enjoying the lowest fuel prices of the last 20 years. This has led to production plummeting.

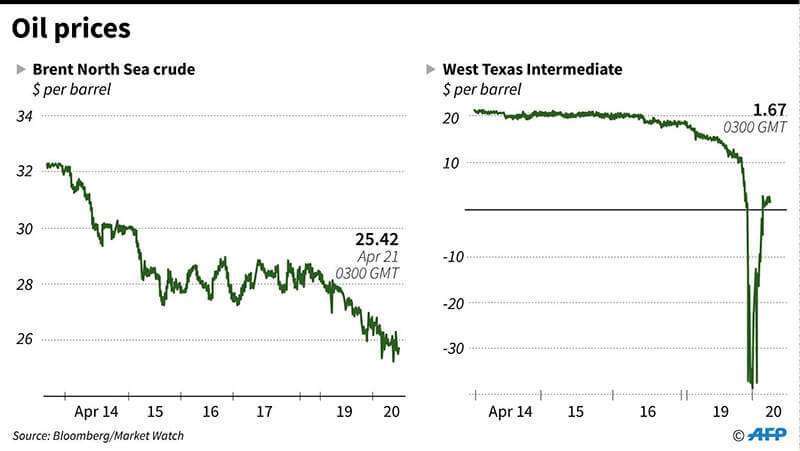

In this scenario, listed crude oil prices in barrels are trading below what they are supposed or expected to be worth in a month's time in the future. Specifically, futures contracts for delivery in May reached minus $37 per barrel in the late afternoon, compared to $18.27 last Friday, leading to the largest drop ever from one session to the next.

Oil on Monday was worthless; on the contrary, it was an added cost or an economic burden (storage costs and is now unprofitable because of the loss of value of the product, which is not disposed of, as is often said in colloquial terms). The negative quotation meant that producers had to pay customers $37 to take barrels that nobody wanted at the moment. "People are trying to get rid of oil and there are no buyers," said Michael Lynch, president of Strategic Energy & Economic Research.

The leap of faith is impressive; oil in the US in 2011 was worth 114 dollars, twelve months ago it was at 66 dollars, on Friday at 18.27 dollars and this Monday at -37 dollars a barrel, which is unusual.

US crude oil has never traded negative since data became available. But looking for some similar comparative background, Rapidan Energy estimates that if we consider the price at net inflation, we would have to go back to 1862, that is, when the first oil wells were discovered in the United States and drilling was an expensive investment because there was no mass market yet, to see something similar.

The worrying situation experienced in the North American market is partly explained by the proximity of the expiry of the WTI Texas futures contracts for delivery in May, which expired last night. Many traders were determined to divest themselves of their positions and some were even willing to lose money.

Every 21st day of every month a contract change is made at WTI, and every 30th day the same thing happens in the case of the North Sea Brent barrel, with prices for the following month. The negative trend continued in both markets, but the first market distanced itself severely from the second in a bad way. Brent, the benchmark crude in Europe, is $64 more expensive than the US, and remains in positive territory, trading at $25.87 a barrel.

The reasons for the gap have to do with technical issues. When an investor buys oil on the market, he does not get a barrel as such to take away with him at the moment, he actually buys a futures contract. These contracts, which are used as a reference for calculating the price of WTI, were due to expire now and the oil will be delivered in May, when the physical delivery will take place, with the problem that storage limits are being reached because no fuel is being consumed. Meanwhile, the Brent will be delivered in June, when it is expected that there will be less imbalance between supply and demand, and it does not require storage as in the case of the US, as it comes from the North Sea field and can be transported with some ease.

Last Monday's price reflected an unusual market situation for May, but it will have nothing to do with June's value, given that when the June futures contract comes into play, the price is estimated to be between 22 and 25 dollars a barrel.

One of the most palpable consequences of these prices is that the North American oil industry is entering a crisis of extraordinary proportions.Not surprisingly, according to the oil services company Baker Hughes, they have already closed half of the oil infrastructures in operation in the United States, from 1,012 a year ago, 529 remain for the moment.

Meanwhile, the Organization of Petroleum Exporting Countries (OPEC) oil-producing nations spent the past month producing more crude oil than ever before, after Russia and Saudi Arabia scrapped the pact to cut back on their production from 2016. Last week it was agreed to cut back on pumping crude oil, but it was too late given the current situation of stagnant economic activity due to the current health problems. For its part, Donald Trump's US government had flooded the oil market by boosting extraction through 'fracking', when previously it had become a staunch advocate of cutting production.

In this way, the main problem facing the United States is the storage of oil already produced, which the market cannot absorb due to the sharp drop in demand.

The current situation is not easy because it is characterised by a drop in demand, to levels almost unprecedented in history due to the coronavirus pandemic; oil storage capacity is almost exceeded, with closed oilfields and a situation in which there is no sign of an improvement in economic variables in the coming months, for which it is predicted that part of the economic activity will continue to be suspended and consumption will drop to levels never seen before.

Along these lines, Jorge Piñón, an energy expert from the University of Texas (USA), told the BBC World that the crisis generated by the spreading of the coronavirus has further aggravated the gap between oil production and consumption at a global level. And the United States, as the world's largest oil producer since 2018, is not oblivious to this. "The problem we have today, and the Achilles' heel of the hydrocarbon industry, is not supply. We all know that there is enough oil in the world, the problem is in the demand and how it is going to recover after this crisis," he explained.