The easiest Junta for Ignacio Sánchez Galán

A record year of profits, despite the reduction of expenses in Spain, makes the general meeting of shareholders of Iberdrola the easiest, most predictable and most successful for a company that promises to continue satisfying its shareholders for many years. A meeting that will be held next Friday, June 17, 2022, in Bilbao.

The main shareholders of Iberdrola clearly support Galán. The Qatar Investment Authority, which owns nine percent of the Spanish company, has expressed through its emir, during his official visit and in front of the King of Spain, its satisfaction with a management clearly successful for dividends and for the company itself.

The famous BlackRock fund, with more than five per cent of the capital, and Norges Bank, the Norwegian bank that owns almost four per cent of the power company, are not far behind. Both, with their very likely positive vote at the meeting, are betting on Galán for many years to come and a long life of profits. So is Kutxa, the Basque financial institution par excellence, which is the closest relative of Iberdrola, also Basque.

All the proxies, or at least the most important ones, propose to vote in favor of all the items on the agenda of the general meeting. Among them is ISS, the world's largest proxy advisor, which provides services to six of the top ten investment funds, insurers and large investors. ISS has recommended that Iberdrola's 600,000 shareholders vote in favor of each of the twenty items on the agenda. All twenty.

Despite the records of quorum that Galán beats year after year, this time he has taken the risk of paying an implication dividend of 0.005 euros if they reach more than 70% of quorum. This president is certainly not afraid, neither of the masses nor of the vote.

Some accidents of course have been easily solved this year by Ignacio Sánchez Galán: from the dismantling in front of the National Audience that it was Iberdrola that was spied, to the setting on the cardinal points of a government that had to rectify and whose error of the decree of September 18 made it go back.

Galán does not only have the approval of the big investors. Smaller shareholders, the minority shareholders, expect Galán to show his muscles again this year at the next general meeting of shareholders, probably even more easily than in previous years.

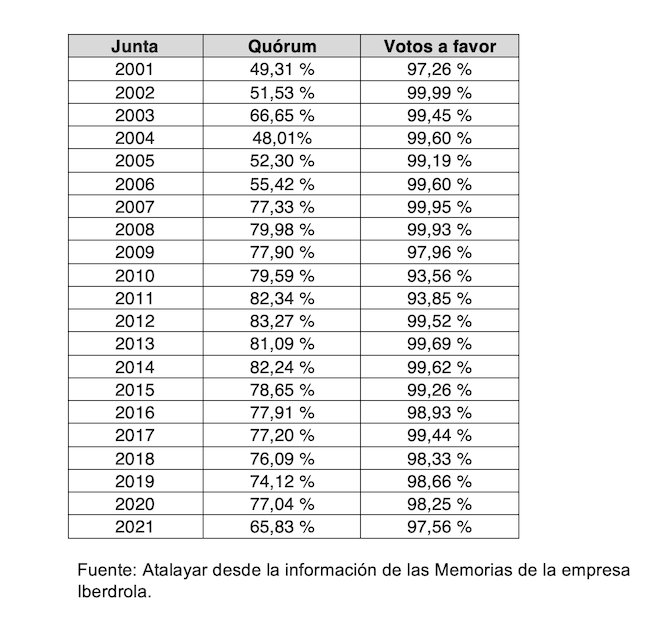

In 2001, Iberdrola's AGM reached a quorum of fifty percent, which puts the average for the last fifteen years, with Galán at the helm, at around eighty percent of participants. Twenty years of meetings in which Galán has obtained an average of 98.57% of positive votes. Cooling down.

The following table shows the remarkable evolution of the quorum and the positive vote of the one who is considered by the Harvard Business Review as one of the five most important CEOs in the world. This year, in what should be his most successful meeting, more good news is expected for shareholders and employees, suppliers and customers.