Emirati non-oil private sector posts record growth in two years

The Gulf countries are heavily dependent on 'black gold'. Oil is the backbone of their economies, but rather than a positive factor, it is a burden for states when crises affect the hydrocarbon sector. Their entire economy is damaged. One of the lessons of the pandemic has been precisely this: to focus on economic diversification in order to minimise dependence on oil.

Saudi Arabia and the United Arab Emirates are particularly committed to this goal. So far, the success of their respective campaigns has been relative. Although both states have laid the first stone, there is still a long way to go to shield themselves against potential crises similar to the one caused by COVID-19, which plunged oil prices by more than 20 per cent by the end of 2020. The setback, coupled with the price war between Moscow and Riyadh, affected all exporters.

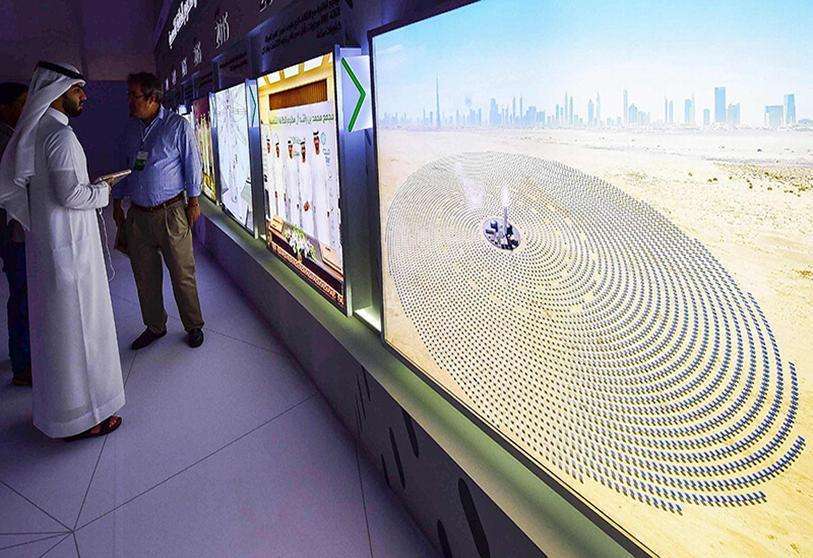

The Emirates is ahead of the pack. Abu Dhabi concentrates for itself the commercial and financial power of the Arabian Peninsula thanks to its ability to attract regional and international companies. This has led Saudi Arabia to compete with its neighbour, launching an all-out war to entice the private sector and generate revenues beyond the energy sector. To this end, the two states are adapting laws to suit investors and promoting an economic transformation that in Riyadh has a name: Vision 2030.

The COVID-19 crisis eventually spread and branched out to affect the remaining economic sectors. This in turn limited the diversification expectations set by the Gulf countries at the beginning of 2020. However, the UAE is beginning to reap the first fruits after a few months of impasse, and is now moving forward with its plan to compete not against regional capitals, but against global ones.

The growth rate of the Emirati non-oil private sector rose from 52.2 in June to a score of 54.0, a two-year high, according to the UAE Purchasing Managers' Index (PMI). This economic indicator reflects a country's economic situation through monthly reports and surveys of private sector manufacturing companies. Those conducted this July indicate that, due to increased demand, growth promises to be exponential in the coming months.

The private sector outside the Emirati energy sector senses that the easing of COVID-19 restrictions and the hosting of Dubai Expo 2020 in late 2021 will lead to an improvement in economic conditions. The optimism comes on the back of this rise, which in turn brought with it a rebound in output to 57.1 in July from 53.6 in June. The survey also showed an increase in employment. Companies continue to hire staff in the face of the exponential increase in sales. Despite the timid figures revealed by the report, this was the fastest rate of job creation since the beginning of 2019.

The data seems to be a response to the measures put in place by the Emirati authorities. A new relaxation of the requirements for entrepreneurship in the country came into force on 1 August. The administration's efforts are moving in this direction, i.e. to make it as easy as possible for the private sector to work and increase the economic machine to counterbalance the oil sector.