IMF: financial and regulatory reform agenda helps accelerate Saudi economic growth

The International Monetary Fund (IMF) issued a positive report on the Kingdom of Saudi Arabia following the conclusion of Article IV consultations with the Saudi Kingdom.

The IMF report confirmed that Saudi Arabia's financial and regulatory reform programme helped accelerate the growth of the Saudi economy, contain inflation and reduce the unemployment rate to its lowest levels in history. The IMF praised the ongoing economic transformation and efforts to diversify the economy under the Saudi Vision 2030.

The IMF Article IV Consultation report praised the macroeconomic policies and transformational changes implemented by the Kingdom, which contributed to improved growth in non-oil activities.

The report also noted that Saudi reforms led to an increase in employment, which now exceeds pre-COVID-19 figures, and that women's labour market participation rate increased to over 35%, surpassing the Saudi Vision 2030 target of 30%.

The IMF welcomed the steps taken by Saudi Arabia to plan for long-term financing that supports the implementation of Vision 2030 initiatives, programmes and projects, while mitigating risks of overheating.

The report also noted that the Kingdom's fiscal space is sound and sovereign debt risks are low, adding that Saudi Arabia's abundant financial buffers have limited the impact of global and regional challenges.

The IMF report highlighted that ongoing reforms in the Kingdom - including those aimed at ensuring effective enforcement of regulations, streamlining tariffs, improving human capital, increasing Saudi women's participation in the labour market, facilitating access to land and finance, and improving governance - have contributed to improving private sector growth and attracting more foreign direct investment, in addition to the significant progress in the field of digital transformation and artificial intelligence underpinning these efforts.

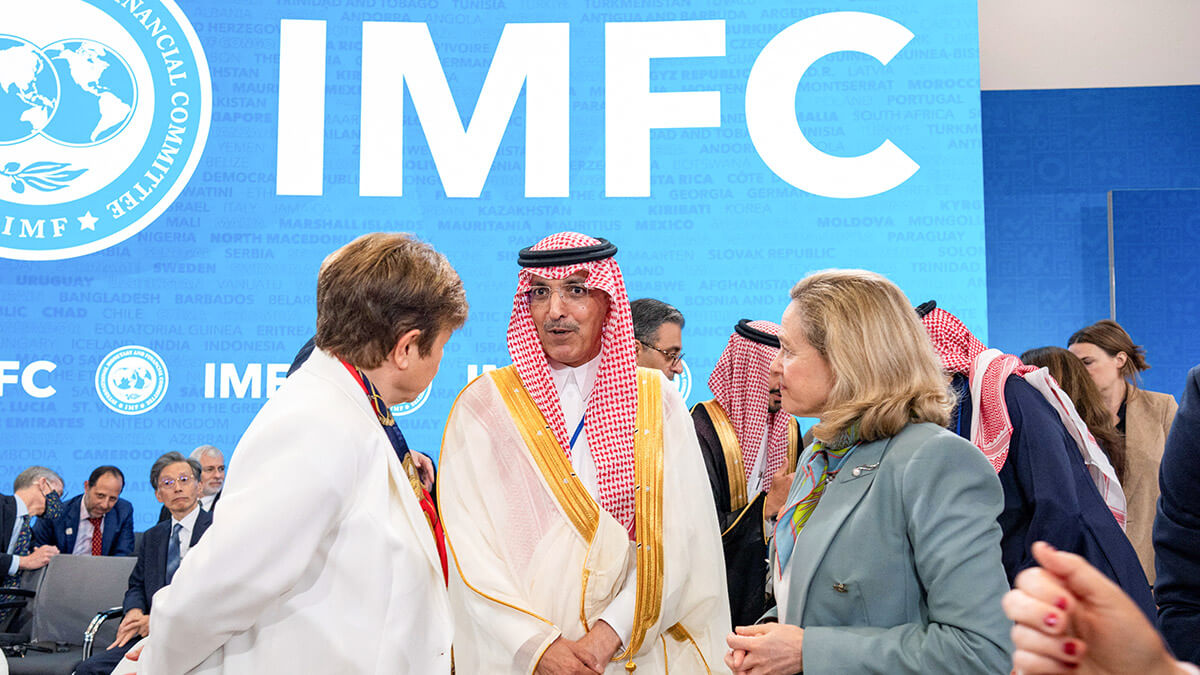

IMF executive directors praised Saudi Arabia's leadership role in multilateral fora, including its chairmanship of the IMF's International Monetary and Financial Committee (IMFC), contributing to efforts to address global challenges.

The report also highlighted increased activity in the services sector, including transport, trade, commerce, tourism and finance, as a result of consumption growth that reached 5.7%.

The IMF said applications for foreign investment licences reached record levels in 2023, as they roughly doubled compared to 2022, including 330 companies applying for licences to establish their regional headquarters in the Kingdom.

The report analyses developments in the Kingdom's banking sector, highlighting its sound solvency and liquidity levels, and its flexibility in the face of shocks. The IMF notes that the banking sector is in a sound position and also highlights the efficiency of banking intermediation, as measured by profitability, infrastructure and competitiveness indicators.

The IMF report also highlighted the rise of the Saudi Stock Exchange (Tadawul) index of 14.2% in 2023, outperforming Morgan Stanley's emerging market index of 7%, while noting progress in the technical environment that facilitates investment and the licensing of three digital banks. The IMF highlighted their contribution to improving financial inclusion and competitiveness, as these banks are characterised by flexibility and innovation.

The IMF highlighted the Kingdom's containment of risks stemming from rapid real estate credit growth, through various government support measures, the soundness of banks, full recourse mortgages and other support measures. It also highlighted improvements in the automation of the national matrix for assessing money laundering and terrorist financing risks, and improvements in the accuracy of the analysis of risk-related data received from reporting entities, including financial technology firms.

The IMF report noted that the increase in non-oil revenues reflects the effectiveness of existing reforms, which directly contributed to improved compliance, and commended the alignment of customs procedures with international best practices.

The IMF expects the non-oil sector (which includes government activities) to grow by 3.5% in 2024, supported by strong domestic demand. The IMF also stated that the inflation rate in the Kingdom is likely to remain stable at around 2% over the medium term, supported by the peg of the Saudi riyal to the US dollar and local policies consistent with Saudi Vision 2030.

The IMF confirmed that the Kingdom has one of the lowest levels of carbon intensity among all major producers, due to ongoing environmental reforms and the Kingdom's efforts to achieve net zero emissions by 2060.

The report highlighted the Kingdom's success in securing a 30-year purchase agreement for the green hydrogen project at NEOM to achieve its efforts to use renewable energy sources.

The IMF noted that, with the aim of capturing approximately 44 million tonnes per year by 2035, the Saudi government intends to build one of the world's largest carbon capture and storage plants, to be operational by 2027, with a capacity of 9 million tonnes of carbon dioxide per year. The IMF highlighted the Kingdom's current efforts to capture 1.3 million tonnes of carbon per year through the SABIC Plant and the Uthmaniyah Gas Plant Department.