Morocco shows great commercial attractiveness

Morocco has been ranked as the third most attractive country for trade in Africa, according to the recent Country Brand Ranking report by the trade and branding agency Bloom Consulting.

The report, in its 2024-2025 edition, notes that Morocco's good development in this area is supported by a boom in demand for digital commerce and online activity, as well as good data in terms of foreign direct investment (FDI).

Only two continental giants, South Africa and Nigeria, outperform the North African country in the rankings, a testament to Morocco's strong performance in this sector.

The report highlighted Morocco's rise as a key commercial centre on the continent, considering that from one year to the next it has moved up one place in the ranking to third on the scale, something that the North African country has achieved for the first time in the ranking presented by Bloom Consulting.

The report highlights as factors in Morocco's favour in this qualitative leap the stability of foreign direct investment and the growing digital business activity in the Moroccan kingdom.

‘Morocco rises to the Top 3 regionally for the first time, supported by its stable foreign direct investment, D2 digital demand and online performance. The improvement in its rating score and social media presence, despite maintaining a CBS Rating (A), reflects Morocco's growing influence and strategic positioning in African trade,’ the report explains.

Morocco is now ahead of Egypt, which is in fourth place, and Ghana, which is in fifth place. Indeed, the report notes that Ghana ‘has not been able to compete with the improvements seen in Morocco and Egypt’.

In the top 10 list are Ethiopia, Senegal (up no less than 11 places), Uganda, Kenya and Tunisia, respectively. The report attributed Senegal's impressive rise to the high growth of its foreign direct investment.

Meanwhile, the UK secured the top position globally for the second consecutive edition, followed by Germany, the United States, Brazil and China, respectively.

Bloom Consulting's Country Brand Ranking report assesses and measures the effectiveness of countries' brand strategy in attracting investment by analysing key data across multiple dimensions.

It uses a proprietary algorithm that focuses on four variables: economic performance, D2 digital demand, country brand strategy (CBS) rating and online performance. The factors provide a comprehensive overview of a country's brand, economic attractiveness and global market positioning, according to the report.

Bloom Consulting explained that its report aims to provide governments, particularly finance ministries and national trade organisations, with information to optimise their branding strategies and attract foreign investment.

Interest in foreign investment

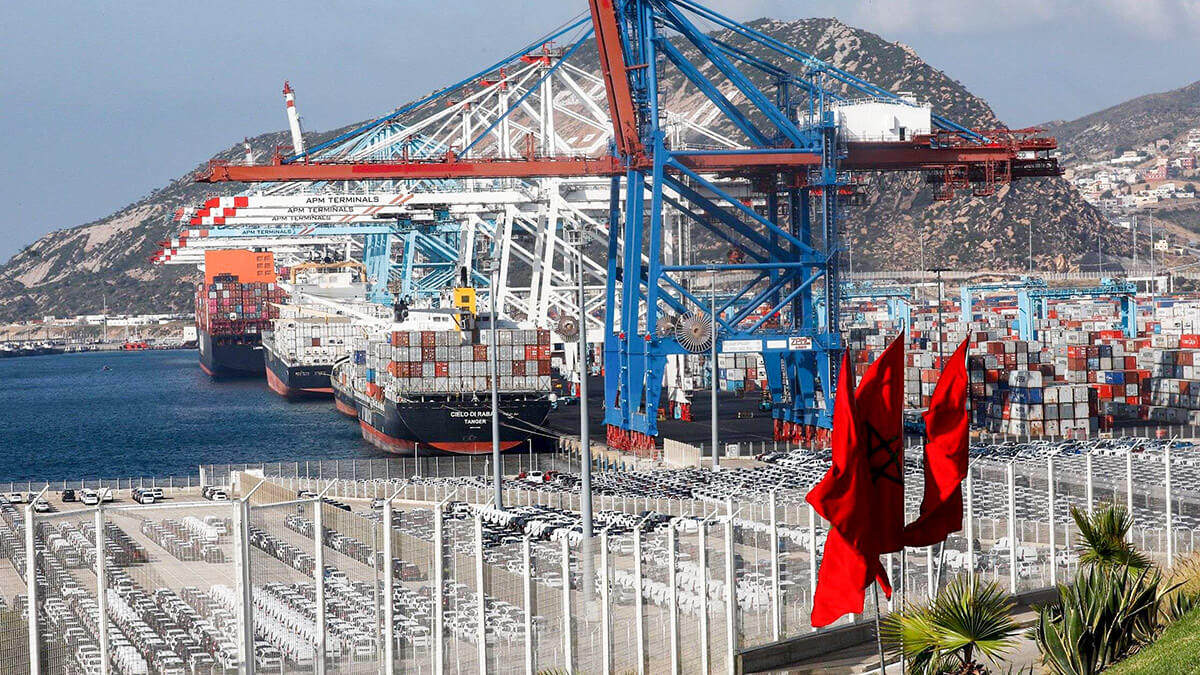

For some time now, Morocco has been boosting its investment attractiveness to attract both domestic and foreign capital in order to further develop the country.

Under the instructions of King Mohammed VI and the actions of the government led by Aziz Akhannouch, a strategy is being drawn up to try to attract as much investment as possible in all kinds of national sectors.

The plan developed through the New Investment Charter, which stipulates a significant amount of money to promote economic activity and important initiatives to make the country increasingly attractive for investment, has a great deal to do with this.

The Moroccan state mobilises very significant monetary resources and applies significant investment incentives that promote investment, mainly foreign investment, in all kinds of areas such as the energy sector, infrastructure, etc., through initiatives such as significant tax breaks for any investor who bets on Morocco or the simplification and digitisation of all types of procedures for all types of companies interested in investing in Morocco.