Trump thwarts global consensus to tax tech giants and billionaires

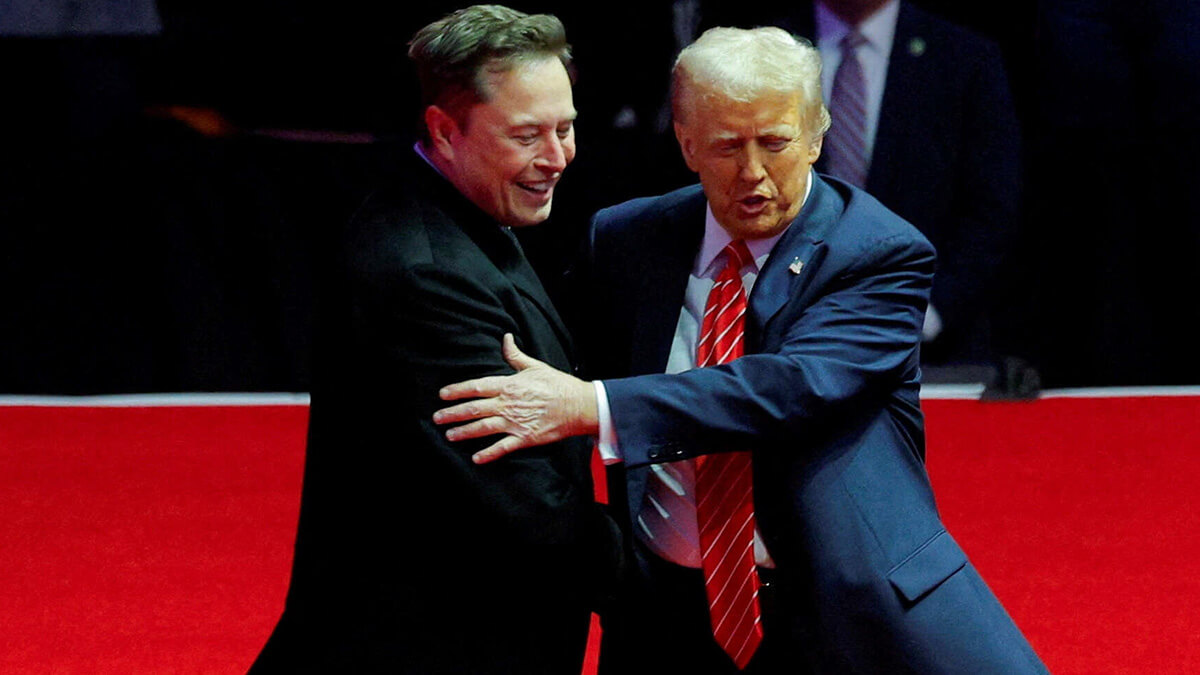

Global efforts to establish a fair tax policy that taxes large tech multinationals and the richest people on the planet face a new obstacle: Donald Trump's return to the White House.

The current US president has already announced the withdrawal of the United States from an international agreement that sought to ensure fair taxation for companies such as Amazon, Microsoft, Alphabet (owner of Google) and Meta (owner of Facebook), reopening a deep rift with its allies.

The move represents a major setback to a consensus reached in 2021 by more than 140 countries under the leadership of the Organisation for Economic Co-operation and Development (OECD), which sought to curb tax avoidance and redistribute some of the profits generated by these companies in the countries where they operate, rather than allowing them to declare profits in tax havens.

This agreement was based on two pillars: first, that multinationals should pay taxes in the countries where they generate profits; and second, a global minimum tax rate of 15% to prevent unfair tax competition. More than 60 countries had already adopted this second point, including key economies such as Brazil, Canada, Switzerland, Japan and the European Union bloc.

However, in a move that has raised concerns in major European capitals, Trump described these measures as ‘discriminatory and disproportionate’ and warned in an official memorandum that his administration would ‘act’, threatening to impose tariffs on countries that apply these taxes, claiming that they are designed to benefit local companies at the expense of American ones.

This is not the first time Trump has resorted to such tactics. During his first term, in response to the digital tax passed by France in 2019, he threatened to impose 100% tariffs on products such as champagne and French cheese. At the time, Paris managed to raise €780 million a year thanks to the tax. Today, other European nations, including the United Kingdom, Italy and Spain, have followed suit, generating billions in tax revenue.

The new scenario poses a particularly delicate dilemma for the United Kingdom, which hopes to move forward with a bilateral trade agreement with the United States. British Trade Minister Jonathan Reynolds was defiant, stating that the digital services tax is ‘something that can never be changed or discussed at all,’ a statement that could further strain negotiations with Washington.

Meanwhile, the European Union is now considering a firm response. The imposition of a common digital tax is not ruled out if negotiations with Washington fail, especially given Trump's threat to impose a 20% tariff on European products. In this regard, economist Gabriel Zucman told AFP that Brussels' response in the coming weeks “will be decisive”.

Trump's decision is not limited to the corporate sphere, but also jeopardises the momentum to establish a global tax on large fortunes. Brazil, which holds the G20 presidency in 2025, proposed a 2% tax on the net wealth of those with more than $1 billion. This tax is estimated to generate up to $250 billion annually. However, both the Biden and Trump administrations have been reluctant to support the project, and with Trump back in power, the chances of moving forward seem slim.

The US rejection has profound implications, as one-third of the world's billionaires reside in the United States, accumulating more wealth than China, India and Germany combined, according to Forbes.

For its part, a recent UBS report suggests that more than 10% of large wealth transfers in the next decade will be directed mainly towards America. Furthermore, it argues that people are more likely to move up than down the wealth ladder, making the implementation of more equitable tax systems even more urgent.

Trump's decision not only jeopardises years of arduous international negotiations, but may also set the course for the global economy in terms of tax justice.