The world economy is preparing for the worst recession in almost 40 years

Beyond the painful effects of COVID-19 on individuals and families, its impact on the global economy is expected to generate the largest recession since 1980. Virtually all countries in the world will experience negative growth in 2020. The recession is affecting supply chains and Crédito y Caución expects world trade to fall by 15% this year, which will be a sharp drop in the historical series. A strong economic recovery in 2021 is still possible. However, the pace of recovery remains highly uncertain and depends on the lifting of containment measures. The economic cost of this recession will be high, given its impact on labour markets, business failures and countries' fiscal situations. Governments around the world are implementing major fiscal packages and loose monetary policy to try to mitigate the effects of this recession.

Advanced economies are expected to be most affected by the recession with a cumulative fall in GDP of 6.6%. The United Kingdom, already overburdened by its exit from the European Union, faces a decline of 10.8%. The performance of the Eurozone is not expected to be much better, with GDP expected to fall by 8.0%. The United States and Japan are expected to experience slightly less pronounced declines of 6.1% and 6.0%, respectively.

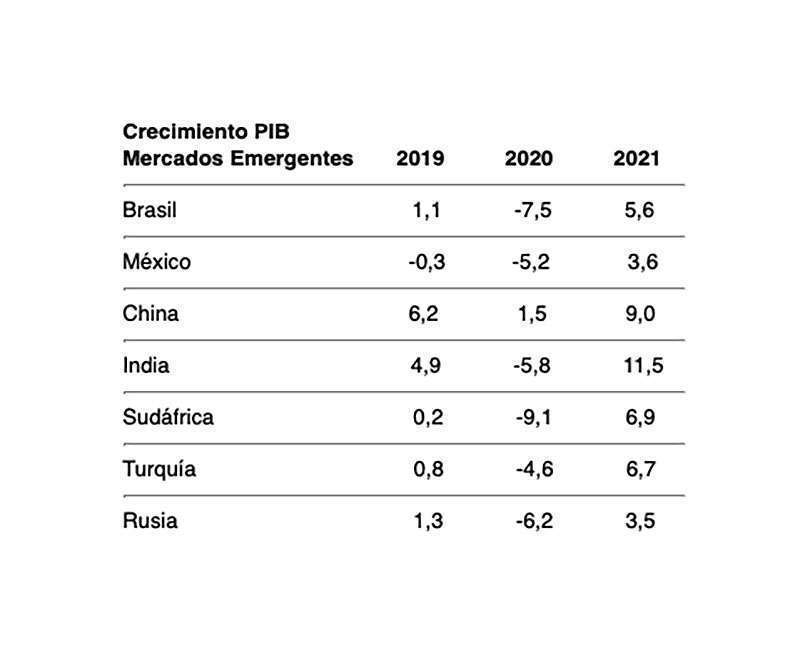

Growth in emerging markets will also fall sharply. The rapid increase in the spread of the coronavirus that has recently occurred in some of the largest emerging economies means that the outlook could worsen in the coming months. China may be the only major economy able to avoid recession this year. However, the projected growth is so low that it could join the rest of the world in negative growth. Russia, which was hit by the COVID-19 while in the middle of a price war with Saudi Arabia, is being severely impacted by low prices for oil, its main source of income, and by confinements which are leading to a fall in demand. This combination of factors has reduced its GDP growth forecast to -6.2%. Brazil has reacted to COVID-19 too late and is now experiencing the fastest increase in contagion of any country in the world. The economic outlook is no better and its GDP is projected to decline by 7.5%. Mexico is experiencing a significant drop in demand from its major export partners in the United States and Canada.

Our main scenario for these projections assumes that a vaccine will be developed or that the world's economies will adapt to the new standard of social distancing in an economically viable way. With these assumptions, we predict a return to GDP growth in 2021, yet at a slower rate than the previous decline. If neither of these two assumptions were to hold, the outlook would be less positive.

Andreas Tesch, Chief Market Officer of Atradius, commented: "The worldwide lockouts, although necessary, have had a huge impact on the global economy. However, when they are effective and successful, they will allow us to return to faster growth. During this unique period, detailed attention to credit management is essential for success".