COVID-19 and remittances: why are Latin American transfers increasing?

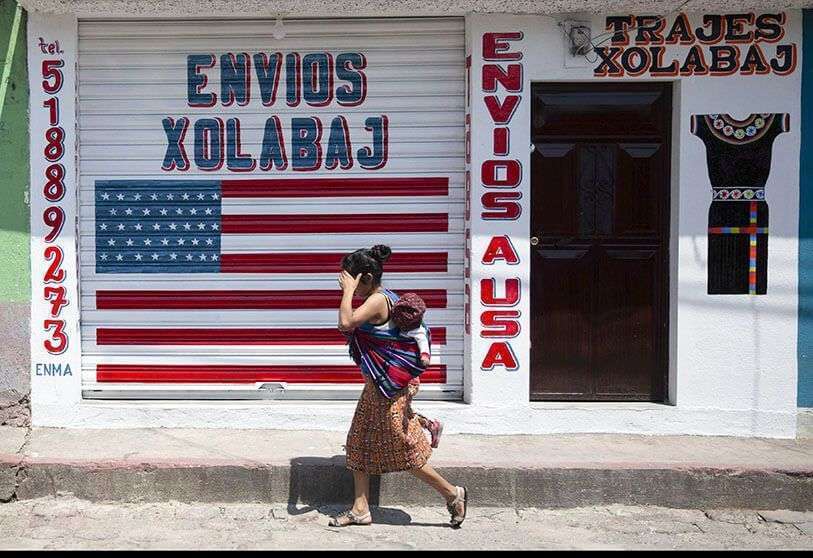

In the first six months of the year, remittances to Mexico totalled $19.1 billion, a year-on-year increase of 10.4%, according to the Bank of Mexico, the Central Bank. This included a record monthly total of $4 billion in March, the month the virus was first detected in the country. Positive trends have also been observed in the Central American countries of Guatemala, El Salvador and Honduras. In Guatemala, remittances increased by 1.4% year-on-year between January and July. Although a fall in transfers in April affected the overall figure, remittances in June and July increased by 9.2% and 13.8% year-on-year, respectively, and the upward trend is positive for the rest of the year.

Neighbourhood in El Salvador, although cumulative remittances fell by 4.7% year-on-year during the first seven months of the year, largely due to a 40% drop in April, payments to the country have recovered strongly to record annual growth of 9.8%. and 14.1% in June and July, respectively. Similarly, remittances from Honduras fell by 3.3% between January and July, reflecting a significant drop in April, but recorded year-on-year growth of 15.2% and 1.2% in June and July.

The results are in stark contrast to the predictions made at the beginning of the year. In April, the World Bank predicted that remittances to low- and middle-income countries would fall by 19.2 per cent by 2020 , the steepest decline in history. This was largely based on fears that the economic downturn and health situation would leave many migrants unemployed or, in some cases, forced to return to their home countries.

While remittances to some Latin American countries have been strong, the overall trend is uneven.

Bangladesh and Pakistan received record inflows for the 2019/20 financial year, which ended in June and included the peak pandemic months of March and April, and the July total of the first $2.6 billion is a single month record. In contrast, however, countries such as the Philippines, Tajikistan and Brazil have experienced double-digit drops in remittance flows since the virus outbreak. One explanation for the positive figures in some Latin American countries is that a large proportion of migrant workers are based in the United States. According to Pew Research, Mexico is the largest recipient of remittances from the United States, with Guatemala, El Salvador, the Dominican Republic and Honduras also in the top 10.

Although the unemployment rate of foreign-born Latin Americans in the US, at 13.5%, was slightly higher than the national average of 11.2% in June, some sectors with strong demand have a significant proportion of migrant workers, including construction, agriculture and food. distribution and retail services. In addition to this, documented workers have been eligible to receive benefits from the US government's federal unemployment programs, allowing workers to continue sending money home. Another significant factor is the change in the value of coins. For example, the Mexican peso has lost about 19% against the dollar since late February, which means that any transfers sent home in recent months have had an inflated value in Mexico.

The flow of remittances will be a crucial factor for many emerging markets to move forward as they continue their recovery from the COVID-19 and the associated economic blockade. For many, inflows from citizens abroad represent a significant proportion of GDP, as seen in Tonga (37.6%), Haiti (37.1%), Kyrgyzstan (29.2%), Honduras (22%), El Salvador (21%), Guatemala (13.1%) and the Philippines (9.9%).

Meanwhile, given the World Bank's predictions that foreign direct investment in emerging markets is expected to fall by 35 per cent this year, the importance of remittances in 2020 is likely to be even greater. As economic growth is also expected to be significantly affected in emerging markets this year, the continued flow of remittances will be a crucial factor in ensuring that many families can continue to pay for essential items.

Despite predictions of a significant drop as a result of COVID-19, remittances to Latin American countries have increased following the coronavirus outbreak. In the first six months of the year, remittances to Mexico amounted to $19.1 billion, a year-on-year increase of 10.4 percent, according to the Bank of Mexico. This included a record monthly total of $4 billion in March, the month the virus first made itself felt in the country. Positive figures have also been seen in the Central American countries of Guatemala, El Salvador and Honduras.

In Guatemala, remittances increased by 1.4% year-on-year between January and July. Although the decline in transfers in April caused a reduction in the overall figure, remittances in June and July increased by 9.2% and 13.8% year-on-year respectively, and the upward trend is promising for the rest of the year. In the case of El Salvador, although cumulative remittances fell by 4.7% year-on-year in the first seven months of the year, largely due to the 40% drop in April, payments to the country have recovered strongly, recording year-on-year growth of 9.8% and 14.1% in June and July, respectively.

Similarly, remittances from Honduras fell by 3.3% between January and July, reflecting a significant drop in April, but registering 15.2% year-on-year growth and 1.2% in June and July. The figures stand out even more than those predicted at the beginning of the year. In April, the World Bank predicted that remittances to low- and middle-income countries would fall by 19.2 per cent in 2020, the largest decline in history. This was largely based on the idea that the economic downturn and health situation would leave many migrants out of work or, in some cases, forced to return to their home countries.

Although the flow of remittances to some Latin American countries has been strong, the global trend is quite uneven. Bangladesh and Pakistan received record inflows in the 2019/20 financial year - which ended in June and included the months of March and April, when the pandemic was at its peak - and the former's July total of $2.6 billion is a single-month record. In contrast, countries such as the Philippines, Tajikistan and Brazil have experienced double-digit drops in remittance flows since the outbreak of the virus began. While the reasons for this global discrepancy are not yet clear, one possible explanation for the positive figures from some Latin American countries is that a large proportion of foreign workers reside in the United States.

Indeed, according to Pew Research, Mexico is the largest recipient of remittances from the United States. Guatemala, El Salvador, the Dominican Republic and Honduras are among the top 10. Although the unemployment rate of foreign-born Latin Americans living in the US, at 13.5%, was slightly higher than the national average of 11.2% in June, many immigrants work in sectors with strong demand, such as construction, retail and agriculture. In addition, a large part of the US Hispanic workforce is believed to have been eligible to receive benefits from the US government's federal unemployment package, allowing workers to continue sending money home. Another factor is the change in the value of currencies. For example, the Mexican peso has lost about 19% against the dollar since the end of February, which means that any remittances sent in recent months have had an inflated value in Mexico.

The flow of remittances will be a crucial factor for many emerging markets to advance recovery from the VICD-19 crisis and the resulting economic blockade. For many, remittances sent by citizens abroad represent a significant proportion of GDP, as seen in Tonga (37.6%), Haiti (37.1%), Kyrgyzstan (29.2%), Honduras (22%), El Salvador (21%), Guatemala (13.1%) and the Philippines (9.9%). However, given the World Bank's predictions that foreign direct investment in emerging markets will decline by 35 per cent this year, remittances are likely to become more important in 2020. As economic growth will also be significantly affected in emerging products this year, the continued flow of remittances will be a crucial factor in ensuring that many families can continue to obtain essentials.