IEA forecasts oil surplus by 2030

As highlighted by the International Energy Agency (IEA) in its latest report, oil markets are expected to be "comfortably" supplied until 2030. Based on the agency's new medium-term outlook, global oil production is expected to increase, easing market strains and pushing spare capacity towards levels not seen since before the COVID-19 crisis.

Based on current policies and market trends, strong demand from fast-growing economies in Asia, as well as from the aviation and petrochemical sectors, will drive increased oil use in the coming years.

However, these developments will be offset by factors such as increased sales of electric cars, fuel efficiency improvements in conventional vehicles, reduced oil use for power generation in the Middle East and structural economic changes.

As a result, the IEA report forecasts that global oil demand, which including biofuels reached just over 102 million barrels per day in 2023, will stabilise at around 106 million barrels per day by the end of this decade.

On the other hand, an increase in global oil production capacity, led by the United States and other American producers, is expected to outstrip demand growth between now and 2030. In this regard, it is worth noting that non-OPEC+ producers are leading the expansion of global production capacity to meet this anticipated demand, accounting for three quarters of the expected increase to 2030.

The US alone could contribute 2.1 million barrels per day of non-OPEC+ gains, while Argentina, Brazil, Canada and Guyana account for another 2.7 million barrels per day.

"The projections in this report, based on the latest data, show a significant supply surplus emerging in this decade, suggesting that oil companies may want to ensure that their strategies and business plans are prepared for the changes that are taking place," said IEA executive director Fatih Birol, who also advised producers to "review their business plans".

Impact on OPEC+

Simon Henderson, an analyst at The Washington Institute, believes that major regional oil players such as Kuwait, Iran, Saudi Arabia and the United Arab Emirates would be most affected by falling prices, which would also undermine OPEC's influence as a cartel.

For the time being, OPEC secretary general Haitham al-Ghais described the IEA's latest forecast as "dangerous", warning of energy chaos if producers stop investing.

Henderson recalls that Saudi Arabia - the largest regional producer - needs high prices to continue funding the Vision 2030 project driven by Crown Prince Mohammed bin Salman. "Lower revenues would probably mean delays that are hard to explain given all the promises made so far," he notes.

On the other hand, for Iran, increased illicit oil exports - assuming sanctions remain in place - would not affect limited government revenues. Among other consequences, this could increase social unrest and provoke mass protests.

Revenues of major natural gas producers such as Qatar - which has the world's third largest reserves after Russia and Iran - are likely to be less affected given the weak link between oil and gas prices, the analyst explains.

Outside the Middle East, Russia remains a major oil producer and could be hit hard in the coming years, especially if war and sanctions continue. "However, China is primarily an importer and, as a result, may gain some advantages," says Henderson.

For Washington and many other governments, too, the IEA's forecast is uncomfortable. Henderson says that, although politicians in consuming countries always welcome lower prices at the fuel pump and are traditionally more concerned about the immediate future than what might happen in five years' time, "the projected oil glut means that Middle Eastern partners may be less able to help financially on regional issues, afford major arms purchases, provide generous subsidies to their people, and so on".

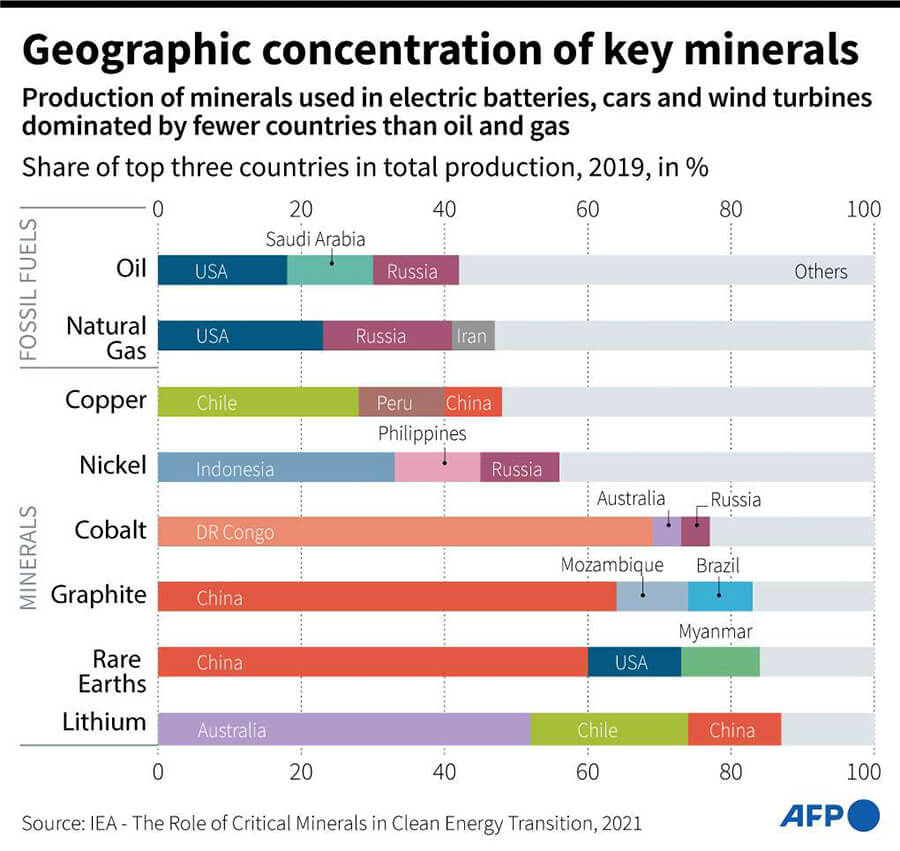

The role of renewables in stabilising oil demand

The expected surplus by 2030 is due to a stabilisation in oil demand, which would be achieved through the transition to electric vehicles and renewable energy. Key countries in the Middle East, such as Saudi Arabia, are already switching to solar and other clean energy to generate electricity, leaving more oil available for export.

In this regard, the IEA also cites the expected slowdown in China's economic growth rate as a drag on oil demand.

Henderson stresses that, regardless of how the supply and demand calculations turn out, "Middle Eastern governments need to redo their oil calculations, whether they admit it or not". "Their economies and, by extension, their domestic and regional power depend on lucid decisions being made well before 2030," he concludes.