Withdrawing from the Russian market is becoming increasingly costly for European companies

The UK's Financial Times published an analysis revealing that Europe's largest companies have made direct losses of at least €100 billion on their operations since the Russian invasion of Ukraine in February 2022.

Through a study of annual reports and financial statements for the year 2023 from 600 European groups, the survey shows that 176 companies have experienced asset write-downs, foreign exchange charges and other one-off expenses as a result of the sale, closure or downsizing of Russian operations.

The overall figure does not include the indirect macroeconomic impacts of the war, which, through higher energy and raw material costs and accelerated arms sales, have resulted in high profits for defence companies and oil and gas groups.

According to a study by the Kyiv School of Economics, more than 50 % of the 1,871 entities owned by Europeans in Russia before the war are still operating in the country, including Italy's UniCredit, Austria's Raiffeisen, Switzerland's Nestlé and the UK's Unilever.

Other research studies have shed light on the situation for European companies still blocked in Russia, such as the list of company positions created by Jeffrey Sonnenfeld, professor at the American university of Yale, or the study by IMD and the University of St. Gall. The Yale list considers all business activities in Russia, while the second study focuses only on equity investments in the form of subsidiaries, which are often costlier to abandon.

Russia's counter-sanctions hamper the withdrawal of foreign companies from the Russian market

In reality, leaving Russia is a real ordeal for European companies. While the sanctions imposed by Western countries did not really come as a surprise to the Kremlin (since this is a weapon the West has frequently used since the Russo-Georgian war of 2008), the decision by private companies to withdraw from Russian territory has really shaken up the economy of the Eurasian giant. Indeed, a large part of the Russian economy depends on the actions of external players.

According to an analysis by the Atlantico news media, Western companies wishing to withdraw from the Russian market first looked for buyers for their assets. However, reaching an agreement is not an easy task, as any withdrawal of capital from abroad is hampered by the Russian government. Nevertheless, the major companies left the country despite the high costs and heavy losses.

The Kremlin therefore took steps to make it more difficult for foreign companies to withdraw from its territory. To begin with, the authorities directly banned investor withdrawals in a number of strategic industries (banking and finance, energy and infrastructure), while making it as difficult as possible to repatriate profits. The government then went further, requiring foreign companies to pay for any withdrawal of Russian assets with a “voluntary contribution” to the Russian budget of 10 % of their “market value”.

Recently, Western companies have been obliged to sell their shares in Russian assets at a 50 % discount and pay a “voluntary exit tax” to Russia. Alexandra Prokopenko, a researcher at the Carnegie Russia Eurasia research centre, says that “finding a buyer is complicated [for Western companies]. No business can take place with the 6,000 or so people and companies on the various sanctions’ lists. What's more, the Russian state has to agree to the sale, and in some cases Putin himself, which can take time”.

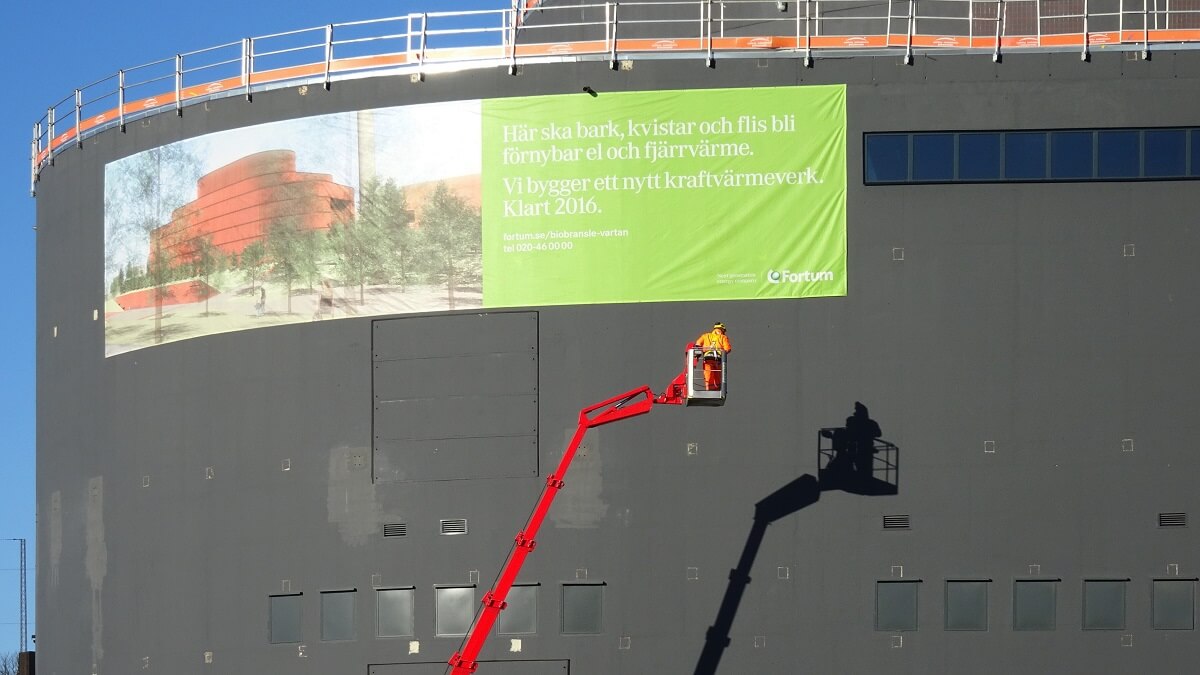

To add fuel to the fire, last April Russia signed a decree giving the Russian state the right to temporarily control the assets of companies or individuals from hostile countries, including the United States and its allies. This decree was immediately used by the Kremlin to take control of the facilities owned by the Finnish company Fortum and the German company Uniper.

On 18 June 2023, the master of the Kremlin signed a new decree requiring companies taking over Western assets in Russia to be owned by nationals, threatening private companies with expropriation. This allowed Russia to control the local assets of Danone and Carlsberg A/S the following month.

As a result, these counter-sanctions are tightening the procedures for Western players to exit the Russian economic market. The Financial Times analysis reports that more than 2,000 companies are looking for ways to leave the Russian market, while others are acting as if the war had not yet broken out, according to the Yale study.

The rapid withdrawal of some companies and the late withdrawal of others are not linked to a question of morals and ethics

According to a study published in mid-January by the University of St Gall and the IMD Business School in Lausanne, 90 % of companies that still have holdings in Russia have not withdrawn from the market. There are several reasons for this, and few of them have to do with moral or ethical issues.

There is, of course, the question of the difficult procedure we mentioned earlier, but the authors also suggest the possibility that many of them do not wish to abandon their Russian customers or staff. In addition, many companies are not subject to the sanctions, which are tailored to each sector. For example, pharmaceutical companies such as Roche and Novartis have no intention of leaving Russia, since medicines are exempt from sanctions on humanitarian grounds.

Nonetheless, companies that found sufficient arguments to justify their activity in Russia at the start of the invasion of Ukraine are facing an increasingly uncertain situation. According to Alexandra Prokopenko, they are increasingly afraid “of being seen as accomplices in Putin's war”. Russia is now perceived as an unreliable economic partner, prompting Western players to consider a way out.

“Companies have lost a lot of money by leaving Russia, but other companies that have stayed have risked greater losses,” said Nabi Abdullayev, a partner at strategy consultancy Control Risks, quoted by the Financial Times. In his view, the best strategy was therefore to cut ties with Russia directly at the start of the war, because “the sooner you leave, the less you lose”.

“The companies that are still there would be better off just writing the company off. I don't think anyone is safe,” KSE researcher Anna Vlasyuk told the Financial Times, “What was the pretext for taking over Carlsberg? Is it really a matter of national security? I don't think so.”

Americas Coordinator: José Antonio Sierra.