Compelling reasons for the end of US imperialism

In fact, there are several experts who compare the American decline with the way in which the Western Roman Empire declined, whose fall occurred on 4 September 476 AD, when the barbarian general Odoacer defeated and killed Orestes and deposed Emperor Romulus Augustus.

That was the final straw for Rome, as a hegemonic power with a wide area of influence and activity that included not only Europe but also Africa and the Middle East. For a whole century, a civilisation based on Roman values was established.

But its decline was the result of a complex process driven by a combination of economic, financial, political, military and social factors, together with external barbarian invasions. Also due to the growing corruption of its political leaders and a web of betrayal surrounded by ambition.

As time went by, Rome's influence in the world waned; it lost territories; it became increasingly expensive to finance its wars and the domestic economy became trapped in a tangle of bureaucracy and corruption.

The Greek writer Christina Athanasiou points out that as the empire struggled to balance its expenditure, the silver content of its Roman coins gradually decreased; there was a devaluation accompanied by galloping inflation and a loss of confidence in the currency.

Furthermore, the cession of key territories further depleted the tax base and Athanasiou, a scholar of the subject, indicates how this affected Rome: ‘It gradually lost control of the prosperous regions, especially in North Africa, which served as the empire's granary; the impact was also felt at the base of the taxable resources, which led to an erosion of income, an increase in budget deficits and the inability to effectively finance its military and public services’.

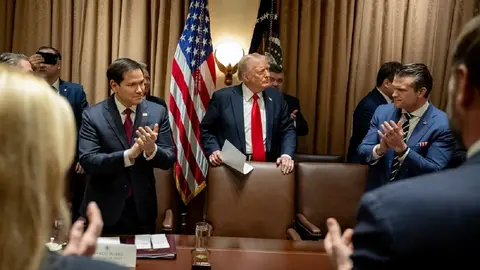

In view of these considerations and drawing a parallel with US hegemony resulting from the Second World War, the big question is: whether the punitive tariff policies imposed by Trump on third countries, plus his stubborn unilateral vision of the United States taking a step backwards in terms of multilateralism and its traditional areas of influence, coupled with poor management of the US economy, will end up accelerating the decline of US supremacy.

Trump is not aiming for collapse, quite the opposite, to stand up to China and stop it consolidating as the new power. However, his decisions are on course to provoke precisely that: a smaller, less productive and less competitive US economy, and a situation in which the ‘soft power’ policy applied by China with its New Silk Road is very welcome in all those countries that the Republican is punishing with tariffs and mistreating with threats. Wherever the United States takes a step back, Beijing will step in to fill the void.

The US's problems are deep-seated, they are not something that came about overnight, they are largely the result of its war economy; it has been the main financier of invasions and civil wars since the end of the Second World War.

After the terrorist attacks of 11 September 2001, perpetrated by an al-Qaeda cell, a turning point was reached when China burst onto the scene after joining the World Trade Organisation just three months after those unfortunate events.

Twin deficits: red alert

The US economy has also been dragged down by twin debt problems favouring budgetary imbalance and economists reiterate the danger of so-called twin deficits.

The private organisation Accounting Insights points out that the economic health of a country is often evaluated by its budgetary and trade deficits. When both are negative, they are called twin deficits, indicating that the government is spending more than it earns while importing more than it exports.

In 2023, US federal interest payments exceeded 659 billion dollars. Indebtedness increases the national debt, which leads to costly interest payments, and if debt levels rise too high, interest payments consume more government revenue, limiting funds for essential services.

A vicious circle is harmfully created to the detriment of economic growth, and as the financial experts at Accounting Insights explain, a budget deficit often leads to government borrowing, increasing the demand for capital and raising interest rates.

‘Higher rates attract foreign investors, strengthening the local currency in this case the dollar, and a stronger currency makes exports more expensive, widening the trade deficit,’ according to these experts.

Thus the imbalance continues to feed itself and the US economy continues to lack revenue, it cannot make payments or meet its budgets; the budget deficit widens and indebtedness continues to be the way forward.

Decline at the gates?

Donald Trump's tariffs are likely to be counterproductive, harming the United States and accelerating the decline of US dominance. This is one of the arguments of economists Radhika Desai, Michael Hudson and Mick Dunford.

Hudson, a researcher at the University of Missouri, analyses that the 1980s were crucial for US hegemony: ‘Neoliberalism came and that is the opposite of industrial capitalism. And so, today, the United States has lost its industrial leadership.’

Although Trump wants the United States to be the dominant power in the new international order that will result from the geopolitical and geoeconomic changes we are currently experiencing, Hudson doubts that the US economy has the strength to maintain its power. ‘What you see in Trump, with his hustle and bustle, is a kind of desperation.’

Dunford, professor emeritus at the University of Sussex, points in the same direction, emphasising that the United States is in a desperate situation: ‘This year it will have to refinance 9.8 trillion dollars of debt. There is a huge pile of debt after many years of fiscal profligacy; moreover, productivity has slowed, infrastructure has collapsed, costs are extraordinarily high for health and education; and, of course, we have deindustrialised due to offshoring’.

For his part, in the opinion of Desai, who has taught at the University of Manitoba, the problem is that the United States has become very deindustrialised: ‘The economy has become so penetrated by imports that every time there is growth, every time people have more money in their pockets, they spend it on imports. That is why the US trade deficit always expands with US growth’.

On Trump's strategy of attracting large investments to the US, Hudson criticises the attitude of almost forcing and even threatening third countries to do so. Trump has asked the Saudi royals to invest more in the US and even threatened the Taiwanese government with tariffs if it does not move a subsidiary of the multinational Taiwan Semiconductor to US territory.

Economists agree that the tariffs will have an impact and that they are a mistake that will motivate other countries to look for new partners and markets. This is favourable for China.

A few days ago, the Financial Times reported that the United States currently accounts for 15.9% of world imports, the majority of which come from Mexico, China and Canada.

Tariffs against trading partners, especially those aimed at China, will not slow the rise of Chinese hegemony, which could be achieved by 2030 or 2050. There is a shift in the sphere of economic power from the West to Asia.

‘We had a deficit of 360 billion dollars last year. Now, if you think about what is happening, basically the United States imports manufactured products from China. China's overall trade surplus is not particularly large, at around 5% of GDP, because China imports large volumes of goods from other parts of the world. China has 20% of the world's population, 5% of the world's arable land and 5% of many critical resources, so it must import many, many things to meet the needs of its people,’ according to Hudson.

Finally, Dunford reflects on what would happen if Mexico and Canada decided to switch their supply chains from the United States to China and increased their purchases of solar panels, batteries and other items, such as electric cars. ‘We would have a very, very problematic situation’.

Economic mourning

Paul Krugman is another economist who is warning about the acceleration of the economic decline and the degree of US influence in the world, and he is doing so by warning that the situation is going to get worse.

In an article entitled ‘The stages of Trumpian economic grief’, the Princeton University professor also refers to the desperation of Trump's economic team, which does not know how to turn the situation around while the first quarter GDP is on track to fall.

‘I would have expected Trump's officials to wait a while, to start offering excuses for having results on a bad economy. But no, they are already telling us to expect difficult times as the economy goes through a period of detoxification,’ Krugman wrote.

The academic, winner of the Bank of Sweden Prize in Economic Sciences, warned that the United States is entering uncharted territory under an aspiring authoritarian ruler. ‘And we know how authoritarian regimes deal with economic adversity.’

Krugman warned that Trump's officials will try to hide the bad news; they will tamper with various indicators by redefining their method of calculation. However, they will not be able to hide the reality: there will be more inflation and possibly recession.

Noah Smith, for his part, talks about a pretty bad scenario and warns that it is time to panic about the growing US national debt.

This blogger and former professor at Stony Brook University warns that Trump's bad decisions will continue to contaminate other spheres: ‘Trump and his party are preparing to massively increase the national debt, at a time when the existing debt is becoming increasingly unaffordable’.

Smith explains that most of the increase in the national debt occurred in three big jumps: the first, under presidents Donald Reagan and George Herbert Bush Sr.; the second, under president Barack Obama in the Great Recession; and the third, under the first administration of Donald Trump during the pandemic.

The worrying point, Smith says, is that as the government refinances more and more of its bonds, it is forced to refinance at higher rates and interest costs are skyrocketing as a percentage of GDP. Those costs are on the verge of surpassing the record set in the early 1990s.

‘That's bad enough. But the bigger problem is that the Republican Party is preparing huge tax cuts that will make the problem even worse,’ according to Smith.

The US economy continuing to lose steam and shrink while reducing its participation in multilateralism and ceding leadership, as well as areas of influence, is not exactly the best of scenarios for the United States to retain its supremacy... it may not even last a century and will end up crumbling faster than the Roman Empire.