Global instability stalls investment in developing economies

Developing markets are experiencing difficulties in attracting foreign direct investment and meeting development goals due to expanding and growing external challenges and the inability of governments to renew their infrastructure, provide incentives and strengthen their legal and institutional frameworks. The most notable challenges are global economic uncertainty, increased geopolitical tensions, trade conflicts and rising protectionism in certain countries, such as the United States under the Donald Trump administration.

The World Bank (WB) stated that capital flows to developing economies fell to 435 billion dollars in 2023, the lowest level since 2005. Developed economies received 336 billion dollars, also the lowest level since 1996. In a report published on Monday, WB experts added that this is due to investment and trade barriers, fragmentation, and geopolitical and macroeconomic risks. Added to this are commodity price fluctuations in countries that are heavily dependent on primary exports. Furthermore, the reduction in hard currency revenues is one of the reasons that has affected the financing capacity of infrastructure projects.

Ayhan Cossy, deputy chief economist at the World Bank, highlighted in a report that the lack of foreign investment indicates that we are facing an alarming situation and that reversing the slowdown is essential to generate jobs, maintain sustainable growth and achieve development goals. His report highlighted that national and global recessions are associated with a decline in foreign direct investment. This decline erodes the possibility of eradicating global poverty and addressing the urgent needs generated by climate change. Cossy also pointed out the importance of national reforms to improve the business climate and global cooperation. This report is based on the latest data available for 2023, which indicates that developing economies must alleviate accumulated constraints, boost participation in the formal economy and promote trade integration.

Climate variability and its effects have led to greater caution in investing and, consequently, a less conducive environment due to the added risks, especially in Asia and Africa, where there is a lack of advanced management systems for environmental risks and disasters. Many developing nations have weak governance, complex bureaucracy and inadequate structures that hinder their improvement in the ease of doing business indicators. Although several states have made significant progress in addressing these issues, disparities remain and cause investors to debate whether to choose these countries as destinations, adding to the factor of persistent internal conflicts in some regions.

Experts are urging countries to work together to ensure the flow of investment to economies most in need of action. Endermitt Gill, chief economist at the World Bank, said that foreign direct investment acts as an engine of growth and is indispensable for trade and investment, estimating that it adds 2 trillion dollars a year to the global level this decade. Gill adds that instead of gradually removing barriers, governments have been amplifying them.

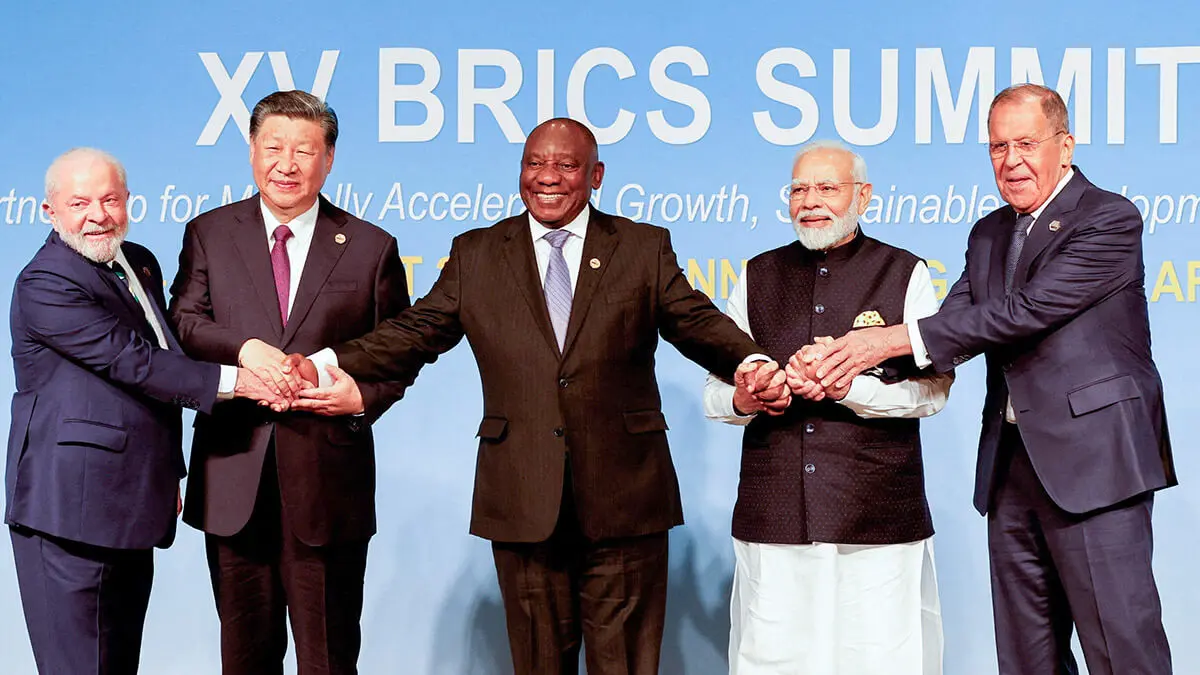

The major developing giants, China, India and Brazil, received half of their inflows in the period from 2012 to 2024, after their rapid development slowed during the 2000s, when it reached 5% of GDP. On the other hand, advanced economies also benefit from foreign investment, accounting for 90% of the total in the last decade. International trade has weakened significantly between 2020 and 2024, reaching its slowest point since 2000.

Global crises combined with changes in global supply chains have fuelled international economic uncertainty and are disrupting investment patterns for country flows, posing a threat to economic recovery and progress cycles. Notably, the World Bank has just lowered its global economic growth forecast for 2025 by four-tenths of a percentage point to 2.3% and warns of rising tariffs and uncertainty across all economies.