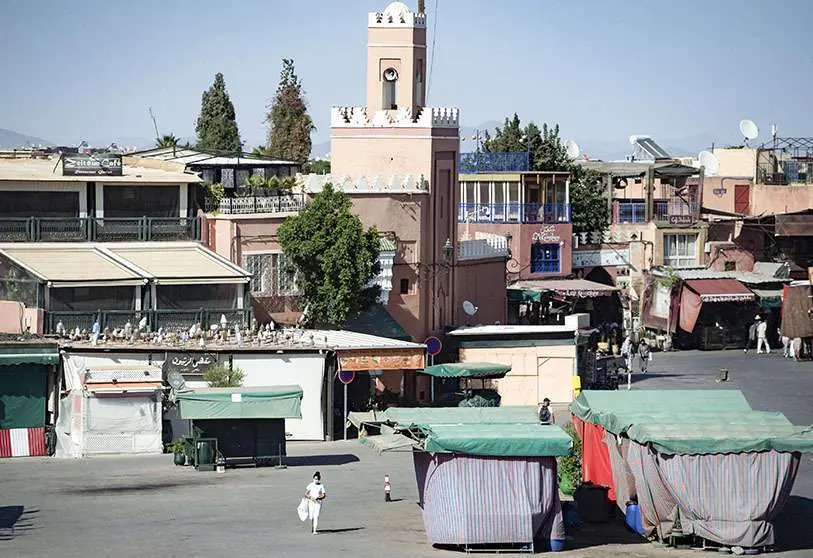

Marruecos disminuye su economía informal a un 30% del PIB

Between 2009 and 2018 the informal economy in Morocco has fallen to a level of less than 30 per cent of Gross Domestic Product (GDP), according to a study on the measurement and evolution of the informal economy in Morocco published on the Bank Al-Maghreb (MAB) online portal.

The results of the study show that the informal economy has three different periods of evolution. Firstly, the period between 1988 and 1998, it remains at around 40% of GDP. The second period is from 1999-2008 and this decreases to 32-34% of GDP. In the third and final period of 2009-2018, it has decreased more than the previous one, but in a less remarkable way, remaining at 30% less of GDP.

It has also been concluded that the strategies to improve the institutional, economic and financial environment that had been implemented since the early 2000s have helped reduce the size of the informal economy.

The study by Kamal Lahlou, Hicham Doghmi and Friedrich Schneider reveals that the persistence of significant informal activities nevertheless requires complementary structural reforms. In particular those of education, the judicial system, fiscal policy and the labour market. They stress this because no single or isolated policy can lead to a significant reduction in the size of the informal sector.

For researchers, the formalisation strategy must include integrated reforms that take into account the complexity and particularities of informality in each sector.

Furthermore, they recommend a series of measures to include the informal sector in addition to structural reforms. The recommendations include strengthening the coordination and monitoring of policies aimed at the informal economy. As well as the continuous evaluation of the evolution of this economy and the strengthening of the detection system through the exchange of information between the different institutions.

In addition, they warn that the capacities and processes of the tax administration should be developed to carry out selective fiscal controls. They also call for awareness campaigns on the benefits of declared work, such as the development of digitalisation of public administration.

Also the collection of taxes and social contributions by a single tax administration. Likewise, the introduction of tax incentives through extensive consultation between the different actors. And the development of the use of electronic payments.