Oil prices under pressure

Between agreements, sanctions and rising production

- Initial blow: poor economic data and expectations of oversupply

- Trade pause and agreement with the EU

- Production on the rise

- Geopolitics and monetary policy

- Limited recovery and many unanswered questions

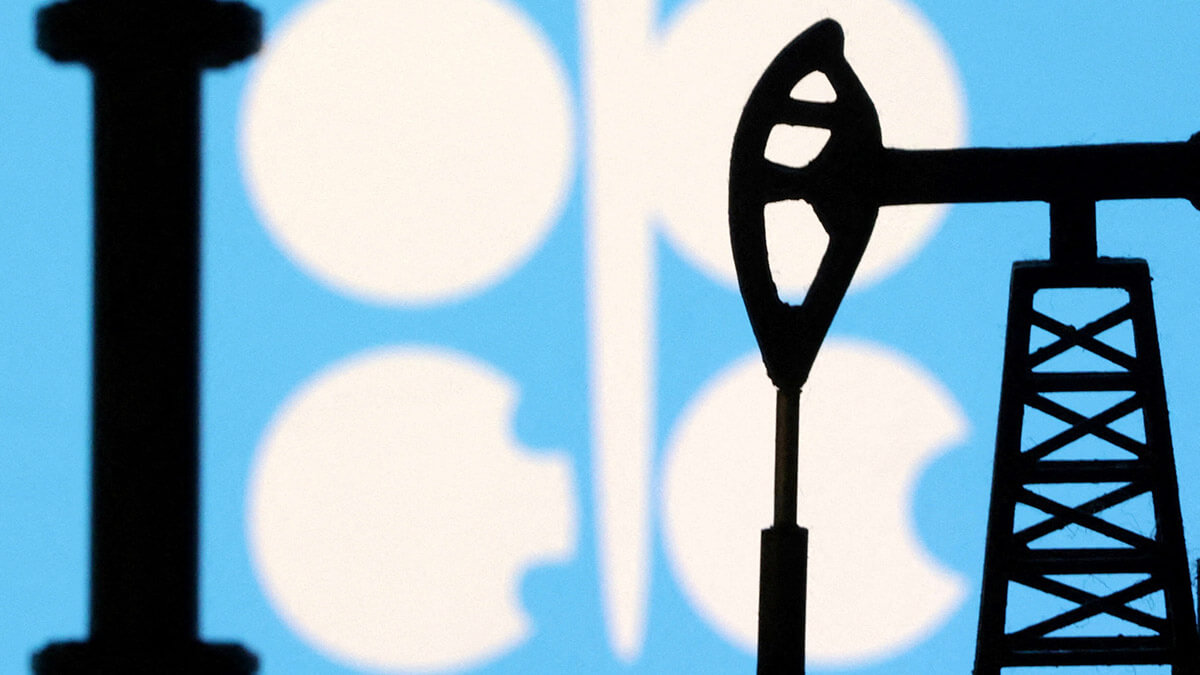

The global oil market experienced days of marked volatility, reflecting conflicting forces between worrying economic signals, new trade hopes and pending decisions by major producers. While oil prices hit three-week lows on Friday, the start of this week brought a slight recovery, which, however, does not dispel underlying doubts.

Initial blow: poor economic data and expectations of oversupply

On Friday, Brent and West Texas Intermediate (WTI) closed at their lowest levels since early July and late June, respectively. Brent lost 74 cents (-1.1%) to end at 68.44 dollars per barrel, while WTI fell 87 cents (-1.3%) to 65.16 dollars. Over the week, the former accumulated a 1% decline and the latter a 3% decline.

The decline was driven by weak data in major economies. In the United States, new orders for manufactured capital goods fell unexpectedly in June. In China, tax revenues contracted by 0.3% in the first half of the year, prolonging a trend of economic weakness.

Added to this are expectations of increased crude oil supply. In Venezuela, the possibility that the United States will allow companies such as Chevron to operate again under limited conditions could add more than 200,000 barrels per day (bpd) to the global market, according to ING analysts. The return of this heavy crude would be welcomed by US refineries but would add downward pressure on international prices.

Trade pause and agreement with the EU

The news that brought some relief was Sunday's announcement of a framework trade agreement between the United States and the European Union. The pact sets a 15% tariff on most European products — half of what was initially threatened — and commitments by the EU to purchase 750 billion dollars in US energy, along with military and strategic investments worth hundreds of billions more.

‘The reduced risk of a prolonged trade war has generated a positive reaction in the markets,’ said Tony Sycamore, an analyst at IG Markets. This type of agreement boosts transatlantic trade and reinforces expectations of higher energy demand, especially for US exports such as liquefied natural gas and oil.

In addition, senior US and Chinese officials are scheduled to meet in Stockholm this week to negotiate an extension of the tariff pause before 12 August. Although the details have not yet been finalised, the possibility of keeping tensions under control is improving investor sentiment.

At the same time, the US has reached an agreement with Japan that includes a 15% tariff and investment commitments worth 550 billion dollars, strengthening the US government's trade strategy but leaving doubts about the direction of talks with China and the EU. The possibility of new rounds of tariffs cannot be ruled out, which is keeping pressure on global markets.

Production on the rise

Despite trade optimism, oil prices face the challenge of a possible oversupply. OPEC and its allies (OPEC+), who are meeting this week, are considering increasing production from September. Four delegates from the group said that while there are no plans to alter the 548,000 bpd increase already planned for August, there is room for a more aggressive rise.

ING analysts anticipate that the group could restore all of the 2.2 million bpd it voluntarily cut, which would mean at least an additional 280,000 bpd by September. ‘The group is looking to regain market share, while summer demand helps absorb some of the extra supply,’ they explained.

At the same time, Russian exports from western ports will fall in August to 1.77 million bpd, compared to 1.93 million in July, which could help offset the impact of Venezuela's return. This reduction comes as the European Union announced its 18th package of sanctions against Moscow, targeting 105 new ships and entities linked to its ‘shadow fleet.’ Although the measure creates uncertainty about its effective implementation, its impact on global supply is still difficult to calculate.

In the US, energy companies have reduced the number of active rigs in 12 of the last 13 weeks, according to data from Baker Hughes, indicating lower drilling activity amid the uncertain outlook.

Geopolitics and monetary policy

Geopolitical risks add to this context. Houthi rebels in Yemen warned that they will attack ships linked to Israeli ports regardless of their flag, as part of their response to the conflict in Gaza. Such threats in the Middle East add tension to an already sensitive market, particularly on Red Sea routes.

On another critical front, Iran confirmed a new round of nuclear negotiations with the United Kingdom, France and Germany for 25 July in Istanbul. The announcement, which reopens the possibility of lifting sanctions, raised fears of a return of Iranian crude to the market, which would add pressure to global supply.

Tensions rose after President Trump defended recent attacks on Iranian nuclear facilities, claiming they were ‘destroyed’ and criticising the media for downplaying their significance. Iran, for its part, confirmed significant damage to the affected sites and warned of possible retaliation if hostilities resume.

At the same time, the US president threatened to impose secondary tariffs of 100% on any country that maintains trade relations with Russia if there is no progress in the Ukraine conflict within the next 50 days. NATO Secretary General Mark Rutte backed the message, pointing to nations such as China, India and Brazil. The statements increase the risk of cross-border economic retaliation and could further isolate some of the world's largest energy consumers.

Meanwhile, all eyes are also on the Federal Reserve. The Fed begins a key monetary policy meeting this week. Although it is expected to keep rates steady, the market is closely watching for any signs of a possible cut later on.

President Donald Trump recently said he had a ‘good conversation’ with Jerome Powell and senses a willingness on the part of the Fed to ease monetary policy. If confirmed, lower interest rates could boost economic growth and energy demand.

Limited recovery and many unanswered questions

The rebound in oil prices at the beginning of this week—with Brent rising to 68.64 dollars and WTI to 65.31 dollars—was slight but symbolic. It reflects a context in which hopes for increased trade and demand are confronted with a reality of growing supply and persistent economic risks.

According to JP Morgan, global oil demand grew by 600,000 bpd in July compared to the previous year. However, global inventories also rose by 1.6 million bpd, showing that the balance remains fragile.

Pending OPEC+ decisions, trade negotiations with China, nuclear talks with Iran and signals from the Federal Reserve, the oil market continues to navigate an uncertain scenario, where every piece of news can tip the balance.