Privatisation and reduced financial requirements for investors in Africa

Financing for the progress of the African continent is a key issue, but it is necessary for reforms to take place, for greater importance to be given to the private sector, for the requirements of African countries to be made more flexible, for there to be stability in the capital markets and for there to be more transparency and good governance. These were some of the conclusions of the session on investment held at the first Africa-Spain Cooperation Summit, which has been held in Madrid since 6 July, organised by One Africa.

Moderated by Dhafer Saidanee, Professor of Finance at SKEMA, Business School (France), an interesting debate was held to analyse the opportunities and drawbacks that investors find in Africa, with the participation of Aldo Olcese, Director General of FINCORP (Spain); José Carlos García de Quevedo, President of the Instituto de Crédito Oficial (Spain); Felix Edoh Kossi Amenounve, Executive Director of BRVM (Ivory Coast); and Albert Alsina, Founder and CEO of Mediterrania Capital Partners (Spain).

Aldo Olcese spoke of the high financial requirements that must be met when investing in Africa, which leads many European operators to decide to cancel their operations due to the impossibility of complying with so many requirements, which is why he advocated a relaxation of these requirements.

He also highlighted the risk management requirements that European and American companies and financial institutions have when investing in Africa, "limitations that make it more difficult for investments to be made".

Olcese spoke of the long road that many African countries still have to travel, since a financial market must have a capital market in which to invest, and, in this sense, privatisation is important, something that African states do not do, according to Olcese, either because governments would have less power, or because they could be accused of having sold out to foreigners, "we must seek a balance, European countries have been able to do so and it is necessary that they do so if they want investments to arrive", the speaker affirmed.

The director general of FINCORP added that privatisation is not possible if markets are not liberalised, which is why "it is difficult for Europeans to arrive if there is no free competition". He also alluded to the lack of savings mobilisation in Africa, firstly, because there is very little savings; secondly, because when there is savings, it goes to other countries such as France or Switzerland, "this has to change and it is time to do so", he said.

Next to speak was the president of the Instituto de Crédito Oficial, an organisation that manages funds from the Ministries of Industry and Foreign Affairs, who explained that they work to provide financing for their partners to develop projects and that they currently have around 600 operations in Africa with investments of around 1,500 million euros, initiatives related to infrastructures, agriculture, water, hospitals, education... and in numerous countries such as Morocco, Cameroon, Senegal, Angola, Ivory Coast...

García de Quevedo defended the public-private relationship, the importance of companies that are going to invest having certain guarantees and the need for foreign investors to work with local partners. He also showed the ICO's sensitivity to issues such as sustainability, the fight against climate change and territorial social cohesion.

Finally, he stressed that at ICO, when dealing with projects, they think about markets and profits, so they take into account venture capital; loans for large infrastructure projects or investments in digitisation of Spanish companies and local partners; relationships with local and regional banks to whom they provide loans if they take on projects of Spanish companies with local partners; and sustainability, "we must promote the transformation to more sustainable models", he stressed.

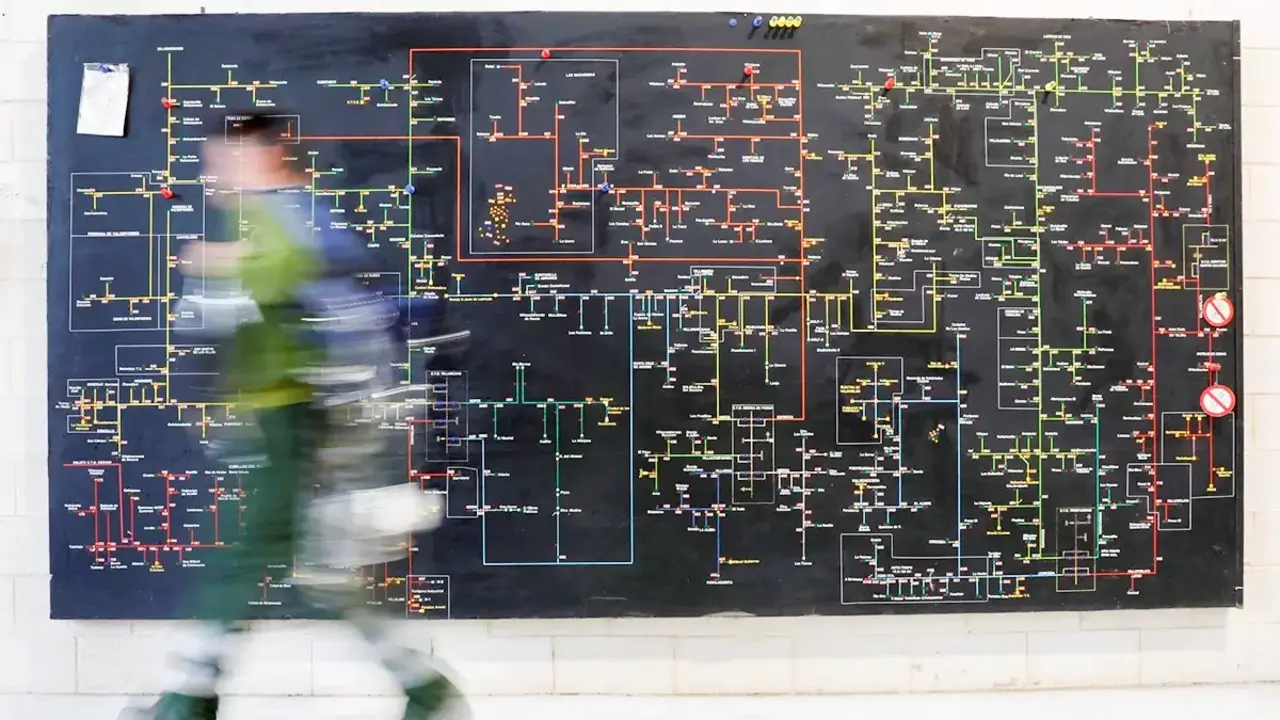

Felix Edoh Kossi Amenounve focused his speech on the stock market, "the last stage of financing". The speaker emphasised that no country has developed without deep and liquid solid capital markets, and that Africa, therefore, "cannot avoid the creation of a stock exchange and capital market, because otherwise little financing will arrive or it will take a long time to arrive".

The executive director of BRVM said that what the African continent needs is long-term capital for long-term financing, and that this is the role of the stock exchange. Currently, he recalled, there are 25 active stock exchanges in Africa with a capitalisation of around 2,000 million dollars.

On the other hand, he stressed that the stock market has two elements to finance development: the debt market and a capital market. In this sense, he spoke of the "enormous" weight of the debt of African economies, but also of the investment funds from which the private sector has been able to benefit and invest.

Like other members of the panel, he defended privatisation in Africa, "states must understand that privatisation is not only exercising their rights over their investment, but also a way of allowing the private sector to improve its competencies", he said, a privatisation that, he said, can be controlled by the state or the state can maintain a participation.

With regard to the Mediterranean countries, he said that they have a fundamental role in the development of Africa and insisted on the importance of the private sector and the importance of helping small and medium-sized companies to reach the stock market.

Finally, Albert Alsina, after recalling how 15 years ago ICO gave them the money to develop, explained the different projects they have successfully carried out in Morocco, from the Casablanca Stock Exchange to investments in the construction sector and the start-up of twelve hospitals. "The return has been fantastic for investors," he said.

The founder and CEO of Mediterrania Capital Partners also commented that these projects have been carried out in conjunction with the Moroccan government and that when it comes to making investments, you not only need a good stock exchange, but also good advisory firms, a good regulator, a strong ecosystem and liquidity.

Another of the conclusions that emerged from this paper, and which was highlighted by the moderator, is that relations with "Africa are changing and represent a new culture, not of compassion, but of business", in which, said Dhafer Saidanee, the aim is for everyone to make money.