Greed vitiates them: unchecked online credit with an ID card and a mobile phone

The law is made the law, the trap is made the trap. The problem comes when those who cheat are entities that make up the economic fabric of a country. They twist the dots as they please so that their business is not at risk. E-commerce continues its unstoppable march in Spain. The pandemic has boosted it with almost 30% more sales in 2020. Electronics is the sector that sells the most and in which banks and lending companies are most interested.

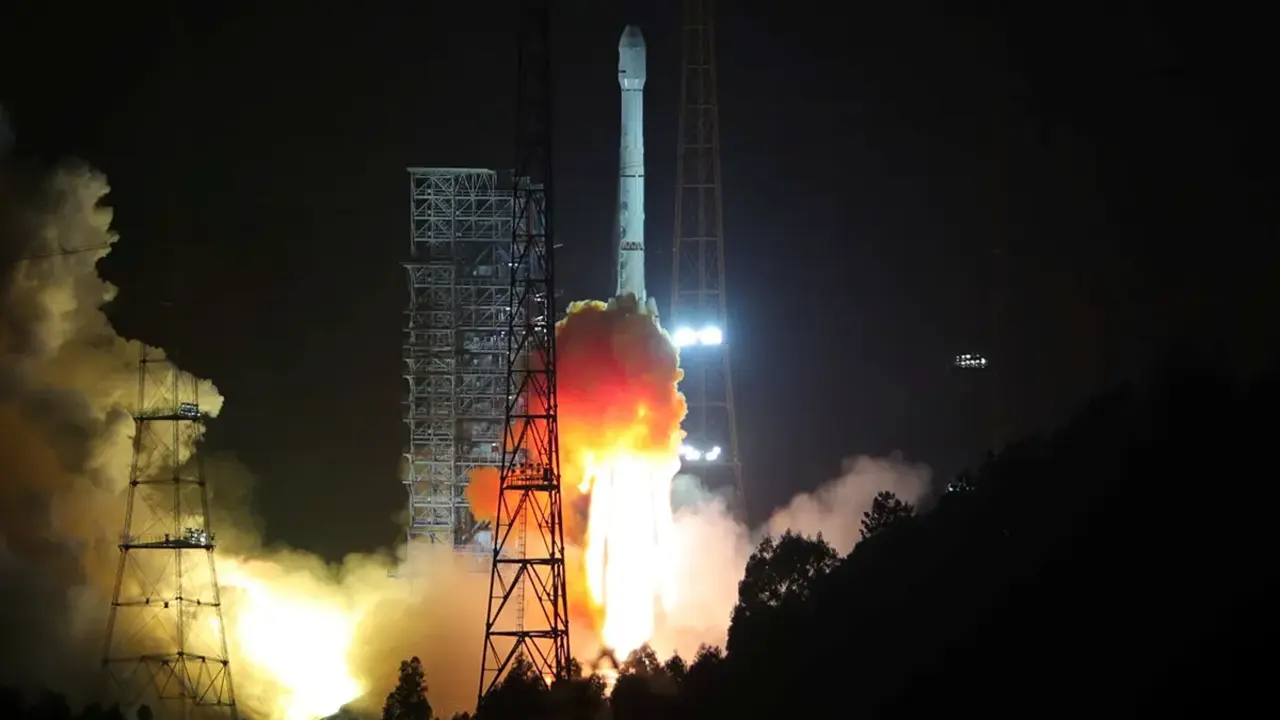

Law 59/2003 refers to the use of electronic signatures and Law 6/2020 regulates electronic trust services. Since the beginning of 2021, banks have had to reinforce the verification of payments through two channels. The financial hole caused by fraud was beginning to be considerable and insurers could not cope with so much crime.

The way to commit a crime on the Internet is very simple: having an ID card and a mobile phone is enough. What's more, with the same ID card and phone number, it is possible to defraud different businesses and obtain credit lines. Whoever commits the crime gets all the products they want and the person whose identity is impersonated is charged with as many debts as the number of crimes committed in their name, as well as being entered in all the delinquency registers.

Andrés wanted to sell his car. He placed an advert on Wallapop and a buyer contacted him. From chatting on the app, they communicated via WhatsApp. The buyer was in a hurry to have the car and asked Andrés for a copy of his ID and an account number to signal the purchase. Fatal error. The seller provided the details and the buyer, after a few days, told him that he could not go ahead and apologised. At that moment, the fraudster began a criminal spiral and, with the ID card and the account number, decided to make a killing.

La Caixa is the entity that grants the MediaMarkt credit card. You don't need to go to a branch or a shopping centre. All you have to do is buy a couple of mobiles on the web and in the payment method you can state that you want a MediaMarkt credit card because you are already a customer of La Caixa. Greed vitiates them and the possibility of a person having a credit of three or four thousand euros with the corresponding interest is a great business. The image of Andrés' ID card and that account number set the scam in motion. La Caixa and MediaMarkt verified the identity with an SMS that did not correspond to the one the bank had on file. But... what difference does it make? A sale, a credit, interest... business. Travel, petrol, hotels and restaurant meals up to 3,000 euros.

The fraudster was kind enough to defer payment in amounts of 30 euros per month so that the defrauded person would not notice it for the first few months. When Andres discovered the fraud, he had three charges on his current account. The customer service of La Caixa and MediaMarkt were unable to empathise with a customer, even if that defrauded customer has a salary, two credit cards, insurance and a mortgage with their brand. If there is no complaint, there is debt, and if there is debt, the debt files will write Andrés' name in gold letters so that everyone knows that YOU DO NOT PAY.

In the end, a complaint at the police station is the only thing that the banks and shopping centres understand in order to take the victim's side. Andrés had to return the receipts to get the money because La Caixa refused to do so. What's more, the MediaMarkt card is still in his name despite his repeated requests for it to be withdrawn.

The case of Jesús is similar. He only sent his ID card by e-mail and someone intercepted the mail. These are risks you run when you use free managers. Everything is exposed. With that ID card, the thief bought two cameras and two mobile phones worth 2,300 euros on the PC Componentes website. The payment was made through the financial company Aplázame, which did not hesitate to grant the credit with that ID and the electronic signature that was made with an SMS to a number that, according to the police, could be a prepaid or a random number without an owner. Once the documents had been "signed", the only thing left to do was to collect the goods. The police also believe that, even if the address is altered from the ID, the scammer could call the delivery person and pick up the package in the street with any excuse.

As the months went by, Jesús received insistent calls from Tradinforme, a law firm specialising in debt collection. The 21st century Frac debt collector calls debtors and gives them a dramatic voice-over telling them that they have a debt and are in arrears. Jesus called and discovered the good life they were living at his expense. Police station, police and complaint. The same way as Andrés to cancel the debt. Another issue will be to remove his name from the registers of unpaid debts.

In Latin American countries, this type of crime has forced banks to make important changes. The new laws oblige entities to assume the coverage of their fraud insurance, so many are cancelling these policies because they do not want to assume the cost of possible infractions. They inform the customer so that they can make their own way and know what they are exposed to. In Europe, this has been regulated, but, as we have seen, with very little success.

And this is the story of online credit concessions in Spain. La Caixa, MediaMarkt, Pc Componentes, Aplázame... are necessary collaborators because of their self-interested laziness. Profit, interest, greed, abuse... have their own name. The laws are for the judges who will one day be faced with a case that is close to the statute of limitations and which they will have to take part in. In the meantime, the internet will remain an unsafe place.