Egypt's plan to increase foreign capital investment

Egypt's current economic crisis is the most serious in its recent history. For this reason, the government is giving the green light to all possible initiatives that favour investment by national giants and foreign companies. Such is the pressure on the country that the International Monetary Fund (IMF) has hinted to the Egyptian government that if there are no changes in the national economy they will be declared bankrupt. The growth of public debt, which has risen to $163 billion, equivalent to 93% of the country's GDP, and the country's financial commitments to allies, such as the $13 billion loan from Saudi Arabia, with the decision to intervene to support the Egyptian state, is the main concern of the leadership.

Over the past ten years, Egypt has received around $92 billion in aid from Gulf nations, but this amount has decreased significantly in recent years. Saudi Arabia announced that it would no longer provide aid without conditions, as it seeks to decrease the Kingdom's dependence on oil and promote its own interests, influence and profits. It criticised Al-Sisi's actions, ostentatious mega-projects such as the new administrative capital outside Cairo and the military's involvement in the economy.

The crisis is so severe that the Egyptian pound has lost more than half its value against the dollar in less than a year, and on 11 January reached its lowest value of 32 pounds to one US dollar. Faced with this situation, the government hopes that the package of measures set to come into effect shortly will remedy the situation. As a central axis for the revival of the national economy, the Al-Sisi-led administration has decided to devote all its efforts to maintaining the Suez Canal area as one of the main investment focuses.

The entry of new companies from both Bahrain and Saudi Arabia into the area is a clear indicator that for businessmen the situation is temporary. "Monetisation of state assets is the key to resolving the crisis, and this requires a real and flexible exchange rate, i.e. further liberalisation of the pound," Bahaa al-Adly, head of the Badr Investors Association in east Cairo, told Al-Arab. In the same vein, he stated that the country will not compromise its future in order to reverse the situation as soon as possible, but that "short and firm steps" will be taken so as not to cause imbalances that could lead to undesirable effects.

The government has decided to take this stance in the face of the economic crisis because, according to Al-Adly and Prime Minister Mostafa Madbouly, the aggravation of the situation is due to the channelling of short-term loans for long-term projects, which, due to external causes, such as the pandemic a few years ago and the current war in Russia and Ukraine, have been paralysed and some have been suspended. To deal with the situation, the executive has several action plans that would be activated simultaneously thanks to investor confidence.

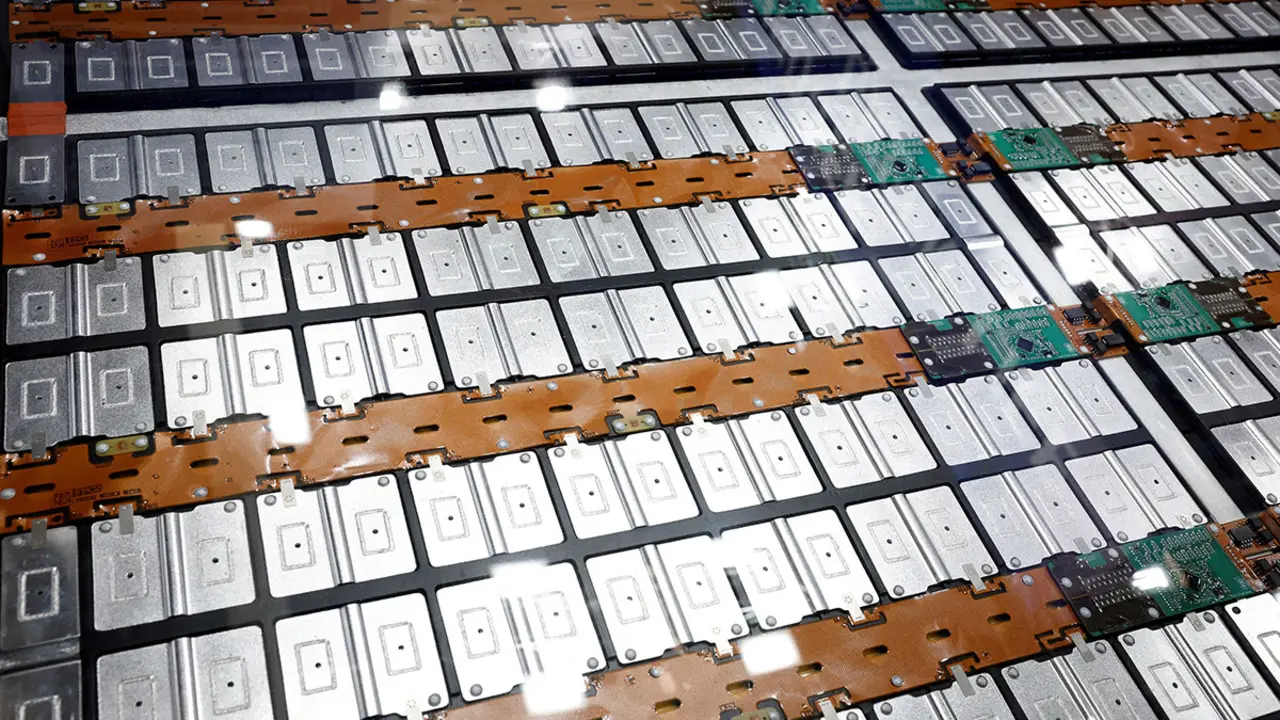

The creation of a Silicon Valley-type economic region would be Al-Sisi's ultimate goal. The country's economy is largely dependent on two areas: the Suez Canal and the "Golden Triangle" comprising the areas of Hamraouin, Al-Nuseir, Marsa Alam, Al-Alaqi and South Shalateen. Within these regions there is a subdivision into 18 zones, of which three are under the jurisdiction of the General Investment Authority, eight under the domain of private entities that have their headquarters and factories there, and seven subject to state power under government agencies. The concentration of the economy in these zones is Cairo's goal.

The state is putting a lot of faith in these zones to attract investment, particularly from the Gulf, because the SEZ system offers incentives and guarantees, including a flat personal income tax rate estimated at 5%, which would be advantageous to investors. In addition, it offers general investor services, an integrated customs administration, a tax division, an investor dispute resolution unit, a project licensing centre and tax advantages for projects located in economic zones. The government is seeking to accelerate and break its sluggishness as one of the Gulf's most important investment havens, a strong indicator of Egypt's direction in terms of long-term growth prospects and investment opportunities for business.

Once the objectives of this programme are met, Gulf, and possibly European and Egyptian, investment will follow, significantly improving the nation's business climate. To prevent investors from wasting their time, money and energy to get what they want, the government has begun cracking down on cumbersome procedures and reducing bureaucracy. Due to intense competition in the Arab world, where nations such as the United Arab Emirates and Saudi Arabia have stepped up their efforts to attract direct investment, Egypt is under pressure to create an economic environment and offer services to investors.

The Egyptian country still offers many investment opportunities and will remain a safe haven for Gulf companies, according to Abdel Meguid Hassan, a member of the Alexandria Investors Association, as noted by al Al-Arab. Since the establishment of Egypt's sovereign wealth fund, he said, "it has become clear that there are promising sectors for investment in the country, especially for Arab investors, such as education, healthcare and food". Hassan urged the government to implement a number of measures to accelerate the flow of investment from the Gulf, such as ending the licensing of new projects and the custom of granting gold licences for major projects.

In addition, he believes that further privatisation of the market is needed to compete fairly with state-owned companies. According to him, the State Asset Policy Paper has been significantly activated to achieve this. In order to raise about $2 billion from asset sales before the end of this month, the government began selling state assets to private investors before the end of the current fiscal year, which is before June. This is in line with Cairo's commitment to reach a target of $2.5 billion by June 2023 in its agreement with the International Monetary Fund.