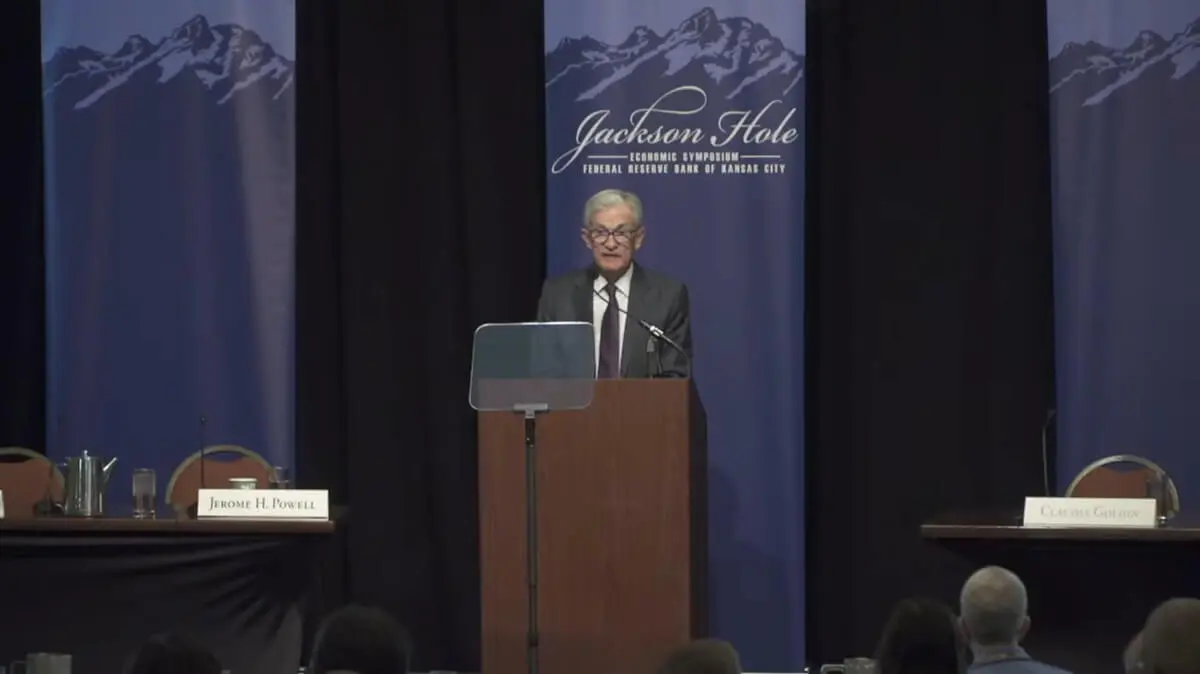

Federal Reserve Chair opens door to rate cut in annual speech at Jackson Hole

Markets reacted with immediate gains to the Fed chair's suggestion that it is time to lower interest rates again

As it does every year, the Federal Reserve Bank of Kansas City is hosting a meeting of central bankers at the Jackson Hole resort in the mountains of Wyoming (United States). The event is attended by the governors of the world's most important central banks, including Federal Reserve Chairman Jerome Powell.

Entitled ‘A labour market in transition: demographics, productivity and macroeconomic policy’, this year's edition is taking place from 21 to 23 August, overshadowed by poor employment figures in the United States and uncertainty about the future of interest rates and Jerome Powell himself, whose term ends next May.

Interest rates

Powell's speech in Jackson Hole has opened the door, as analysts had predicted, to a further cut in interest rates. On the same stage where, exactly one year ago, Powell announced that the time had come to start lowering interest rates, the Fed chairman has indicated that ‘it may be appropriate to begin adjusting our monetary stance’, which could confirm that the cut will begin in September.

Uncertain how the Trump administration's tariff policy will affect the US economy, with inflation above the Fed's 2% target (2.7% in July) and increasingly worrying US employment data (the worst hiring figures since the pandemic), the Federal Reserve has been debating whether to lower interest rates or keep them unchanged in recent months.

Lowering rates appears to be the only option to boost economic growth, even at the risk of causing inflation to rise even further. This is the proposal advocated by President Trump, while Powell has opted for a more cautious wait-and-see approach, keeping rates as they are. This stance prevailed at the last five Fed meetings, despite the first dissenting votes in three decades at the last meeting.

In his speech, Powell also referred to the impact of tariffs on the US economy, with a possible rise in prices: "That price increase may be temporary. Temporary does not mean “all at once”. Price increases will continue to be felt for months as businesses and consumers digest the impact of the tariffs.‘

Regarding the danger of inflation getting out of control, the Fed chairman said that ’we will not allow a temporary rise in prices to turn into a general uptick in inflation."

Market bets

For now, analysts have predicted that the Federal Reserve will lower interest rates, currently at 4.25%/4.50%, by a quarter of a point at its next meeting in September, another quarter of a point in December, and a further quarter of a point in January, in line with Trump's suggestions.

These cuts will provide a boost to the economy and the dollar, but could compromise the Fed's inflation target, which was already 0.7% above target in July.

In the case of the European Central Bank, forecasts suggest that current rates (currently at 2.00%, 2.15% and 2.40%) will be cut by 0.25% in September and remain unchanged at subsequent meetings.

Impact on the stock markets

Meanwhile, capital markets around the world have reacted positively to the Fed chief's hints of a rate cut. In Spain, the IBEX 35 remained above 15,000 points, while the EuroStoxx 50, which has been trading in a narrow range over the last few days, around 5,450 points, was close to 5,500 points at the time of writing.

It should also be remembered that Christine Lagarde is among the guests at the Jackson Hole symposium. The President of the European Central Bank will share the panel at the closing session on Saturday 23 August with the Governor of the Bank of England, Andrew Bailey, and the Governor of the Bank of Japan, Kazuo Ueda.

We will have to wait and see how the markets react to the statements by Powell and the other central bankers at the opening of Monday's session.

Under Trump's shadow

Afterlife of the clues about the evolution of US monetary policy, the Fed chairman's latest participation in this meeting is marked by his confrontation with US President Donald Trump, who has publicly criticised Powell and even called for his resignation for not lowering interest rates, which, in the president's opinion, is what the US economy needs.

The truth is that his last few months at the helm of the US central bank have not been a bed of roses, especially since Donald Trump's return to the White House. The US president's surprise visit to the construction site at the Federal Reserve headquarters in Washington on 24 July (the first by a US president in almost 20 years) did nothing to ease the tensions between the two, quite the contrary. The president has criticised the excessive spending ($2.5 billion) on a renovation that includes high-quality marble, rooftop gardens, lifts and private dining rooms.

Her usual caution when it comes to decisions such as lowering interest rates has not gone down well with the president, who has already manoeuvred to place like-minded people on the Fed's board.

In fact, at the Fed's monetary policy meeting on 30 July, two members voted against Powell's proposal to keep interest rates unchanged, something that had not happened since 1993.

The possibility of Powell being dismissed by the same president who appointed him in 2017 has cooled in recent months, after the US Supreme Court ruled in May on Trump's authority to dismiss members of independent government agencies.