Iberdrola increases its net profit by 21%

Ignacio Galán, Chairman of Iberdrola: "These results confirm our ability to execute our plans ahead of schedule, even in the current challenging macroeconomic scenario. And, by the end of the year, we expect net profit growth of close to 10%, excluding additional capital gains from asset rotation".

Key highlights

- Capital expenditure increased 8% in the last 12 months to EUR 10,544 million, 93% of which was earmarked for networks and renewables.

- The company achieved a net profit of 2,521 million euros in the first half of 2023, an increase of 21% compared to the same period of the previous year.

- EBITDA grew 17% due to investments in networks and renewables, the normalisation of conditions in Europe and the recovery of the trade deficit in the UK, compared to the first half of 2022 affected by high prices and abnormally low renewable production.

Second forecast upgrade to 2023

- Net profit is forecast to increase by close to 10% by 2023, excluding any additional capital gains from asset rotation.

Growth and financial strength

- Increased cash flow to EUR 5,731 million in just 6 months: 21% increase compared to EUR 4,734 million in the same period last year excluding the hydroelectric levy.

- Balance sheet strength: Financial soundness ratios improved and liquidity stood at EUR 20,300 million, covering 21 months without the need for new financing after issuing EUR 3,400 million of new green financing.

- Dividend grows by 11.6%: It stands at EUR 0.501 per share (+11.6%), reaching the floor planned for 2025 two years ahead of schedule.

Acceleration of the Strategic Plan 2023-2025

- Boosting networks: The network asset base grew by 10% in the last 12 months to EUR 40,000 million.

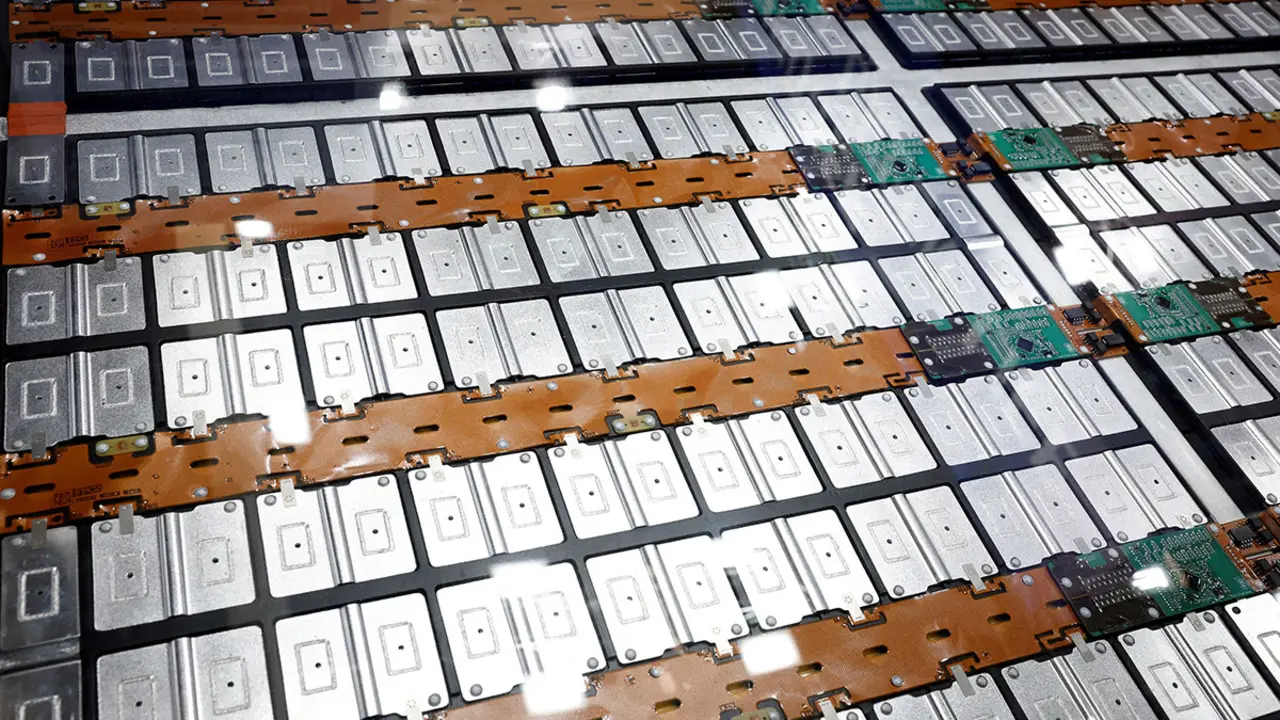

- Increase in installed capacity: Renewable capacity reached 41,250 MW after adding 2,500 MW in the last year. The company has 7,100 MW under construction, which will involve an investment of 12,000 million.

- Energy sold in the long term:

- In 2023, Iberdrola has 135,000 GWh sold through PPAs via regulated mechanisms and with industrial customers (70% of the total, with an average term of 12 years) and domestic customers (30% with an average term of 2 to 3 years).

- Optimal positioning in view of the proposed European Market Design Reform, which is committed to more market and more long-term contracts.

- Asset rotation plan completed: signing of the contract for the sale and purchase of close to 60% of its business in Mexico and new co-investment alliances with companies such as Qatar Investment Authority, Norges Bank, GIC, Mapfre, CIP, Crédit Agricole, Energy Infrastructure Partners, Shell and BP.

Iberdrola is making steady progress on its 2023-2025 Strategic Plan, which enabled it to obtain a net profit of 2,521 million euros in the first half of 2023.

The improved performance of the United Kingdom and European Union countries due to the normalisation of production and lower wholesale market prices have helped gross operating profit (ebitda) to reach 7,561 million euros in the first half of the year, an increase of 17.3% compared to the first half of 2022.

The company has made investments of 10,544 million euros in the last twelve months, which is 8% more than in the same period of the previous year. Of this investment, 93% was earmarked for networks -5,061 million euros- and renewables -4,745 million euros- to accelerate electrification and promote energy autonomy.

By country, Iberdrola has continued to promote its commitment to decarbonisation in all the regions where it operates. In Spain, it has allocated 2,880 million euros, which represents 27% of the total. It has also invested 2,580 million in the United States, 1,957 million in Latin America, 1,533 million in the United Kingdom and 1,595 million in other countries.

ACCELERATION OF THE STRATEGIC PLAN

The company remains firmly committed to the decarbonisation of the planet. "We continue to accelerate the execution of our Strategic Plan, with investments of more than 10,500 million euros in the last 12 months, to reach a Network Asset Base of 40,000 million euros and 41,250 MW of installed renewable energy", said Iberdrola's Chairman, Ignacio Galán.

He also commented: "These results confirm our ability to execute our plans ahead of schedule, even in the current challenging macroeconomic scenario. And, by the end of the year, we expect net profit growth of close to 10%, excluding additional capital gains from asset rotation".

As a result of the investments, the network asset base has grown by 10% to EUR 40 billion, which has improved the company's diversification.

Moreover, Iberdrola remains true to its commitment to driving the energy transition and has increased its installed renewable capacity by 6.5% worldwide in the last 12 months to 41,250 MW. In addition, the company has 7,100 MW under construction, representing an investment of 12,000 million euros.

Its new capacity has enabled the group to increase its own production with clean energy by 5.7% compared to the same period last year, to 42,756 GWh.

In 2023, the company has already sold 135 TWh through long-term contracts (through PPAs and regulated mechanisms). 70% of this energy is committed through contracts with industrial customers with a term of approximately 12 years and 30% with domestic customers with an average term of between 2 and 3 years.

In fact, in recent weeks the company has signed an agreement with Vodafone to supply it with clean energy in Germany, Portugal and Spain for a total of 410 GWh, equivalent to the annual demand of more than 117,000 homes. It has also reached an agreement with Holcim, a world leader in innovative and sustainable building solutions, for 250 gigawatt-hours (GWh) per year of renewable energy from its Baltic Eagle offshore wind farm.

Iberdrola welcomes the ongoing EU electricity market reform. The European Parliament has already taken a position in favour of strengthening the market and long-term contracting, in line with the Commission's legislative proposal.

As part of its Strategic Plan, the company has completed its Asset Turnover Roadmap of 7.5 billion euros by 2025. It has just been announced that the company has entered into a strategic alliance with Masdar to develop a Baltic Sea wind farm and to advance Europe's net zero emissions targets. In addition, the sale of close to 60% of the Mexican business continues and the transaction is expected to close before the end of the year.

In addition, the positive evolution of the business has enabled Iberdrola to increase its profit forecast for 2023. It forecasts an increase in net profit for 2023 of close to 10%, without taking into account the capital gains from the asset rotation plan, thanks to a strong first half of the year - recovery in renewables and customer business - and a series of advantages in the second half of the year - higher installed capacity and increased production.

A ROBUST BALANCE SHEET AGAINST THE MARKET BACKDROP

Iberdrola is accelerating the pace of its investments, while maintaining the strength of its balance sheet. Thanks to the good performance of the company's business, the group has achieved an operating cash flow of 5,731 million euros in just 6 months, compared to 4,734 million euros in the same period of the previous year, an increase of 21% (excluding the hydroelectric levy).

The group has once again demonstrated its leadership in sustainable financing, obtaining 3,440 million euros in new green financing, bringing liquidity to 20,300 million euros. Iberdrola could thus cover 21 months of financing needs without resorting to the market.

In an inflationary context, 86.7% of the debt is at a fixed rate, with an average maturity of close to six years.

A COMPANY COMMITTED TO SHAREHOLDERS

The company's performance was recently endorsed by its shareholders, who met at the General Meeting -with a quorum of 72%- and approved all the items on the agenda with an average positive vote of 98%.

As approved, the company has increased shareholder remuneration by 11.6% to 0.501 euros per share against 2021 results. With this remuneration, the company has already reached the dividend floor set for 2025.