Iranian rial loses 90 % of its value against the US dollar due to domestic energy crisis

Since November 2024, Iran's producers have been affected by power cuts lasting up to two days a week, while the grid suffers the consequences of international sanctions and the lack of foreign investment.

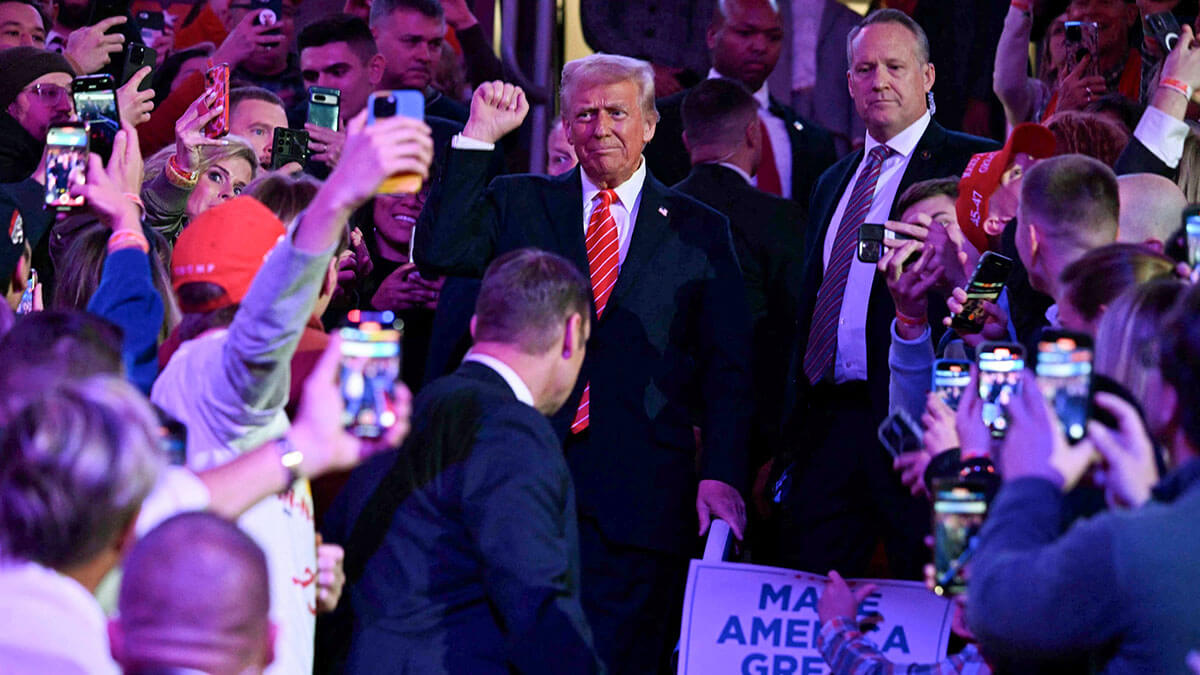

In this way, the Iranian government is preparing for Donald Trump's arrival in power, as he has pledged to exert maximum pressure and place new sanctions on the Persian oil industry. Currently, industrial companies are counting on a number of cutbacks, leading to 30% inflation and a devalued currency.

Iran not only has at stake the survival of energy, steel and car producers, but also the religious regime that has been ruling since the 1979 Revolution. In recent times, Iran's rulers have faced increasing levels of unpopularity, which has been growing due to regional influence in the midst of the Israeli-Palestinian conflict, Lebanon and the overthrow of al-Assad in Syria.

Despite the ceasefire agreement between Israel and Hamas, a direct conflict with Israel remains a possibility. Thus, if Iran were to receive a military strike against vital parts of its network, such as nuclear facilities or other infrastructure, sanctions would make recovery difficult.

Consequences of the energy crisis

Iran's Chamber of Commerce, Industry, Mines and Agriculture estimates that power outages cost the economy approximately $250 million per day. Even 40 % of steel production capacity was unused, according to the state news agency IRNA, so that gas supplies to at least ten petrochemical plants had stopped and gas flows to the cement sector were down by 80 %.

Also, the Purchasing Managers' Index has fallen for nine consecutive months, according to figures released by the Iranian Chamber of Commerce. These declines were related to power outages.

Relative to GDP, relative growth is expected to halve by 2027, according to the World Bank. Exports are also expected to suffer declines. Tehran-based independent energy analyst Daniel Rahmat says Iran's energy crisis is part of a wider domino-like economic collapse, where failures in one sector create knock-on effects in others. Another consequence is that the Iranian rial has weakened significantly against the dollar, losing about 90 per cent of its value in the unregulated open market.

International sanctions

Following the Revolution in 1979, Iran has suffered from a number of international sanctions imposed by various governments and organisations. Primarily, the European Union and the United States have taken it upon themselves to sanction the country's energy industry due to human rights violations, military and nuclear activities.

A 2015 agreement with the United States had as its main idea that Iran would not enrich uranium to a level suitable for the creation of nuclear weapons and, in exchange for this, sanctions were reduced, but Trump withdrew this agreement in 2018 as it was not comprehensive enough and re-imposed sanctions on Iranian energy, shipping and banking.

Then, in June 2024, the West sanctioned three entities and eleven ships for trading oil and petrochemicals with Iran in response to Tehran's efforts to expand its nuclear programme.

In addition, the same country in October 2024 extended its sanctions to the Islamic Republic's oil and petrochemical sector for the Iranian missile attack on Israel. This affected ten entities and 17 vessels involved in the export of Iranian oil.

The EU, for its part, in October 2014, also sanctioned 14 Iranian entities and individuals involved in the supply of ballistic missiles to Russia, which represents a direct threat to European security.

Energy industry

Iran's energy minister, Abbas Aliabadi, warned that the electricity deficit was likely to increase to 25,000 megawatts by the middle of this year, up from 20,000 last summer. He said: ‘The reality is that there are energy imbalances and diversifying production is certainly one of our plans, but it takes time.

In relation to the above, he mentioned that the government has 14 short-term projects planned for the summer. These include work on fuel oil units, easing grid constraints and increasing renewable energy capacity.

Although renewable energy sources are not many, more than 92 % of Iran's energy supply comes from oil and gas, state news agency Shana reported, compared to around 60 % globally.

In relation to this, Iran is increasingly focusing on renewable sources. Thus, Iran's Small Industries and Industrial Parks Organisation (ISIPO) has announced the approval of 24 solar energy industrial parks. And, according to ISIPO Director General Reza Ansari, four of the solar energy industrial parks have already reached the operational stage, with land allocated to interested investors.

On the other hand, Iran has the second largest gas reserves in the world, but has challenges in exploiting them. In this regard, Reza Badidar, vice president of the Petroleum Industry Federation, said the country faces a gas deficit of about 200 million cubic metres per day, which is equivalent to the average daily consumption in Germany.

A key site is South Pars, which took 18 years to complete due to financial disputes and multiple rounds of escalating sanctions. French company Total Energies even made two attempts to help develop the site before pulling out, as a local company subsequently completed the task by taking a used platform from another area of the field.

Iran's energy market is expected to reach 317.1 billion kWh by 2025 and is also expected to grow at an annual growth rate of 0.87% for the period between 2025 and 2029, according to Statista data.