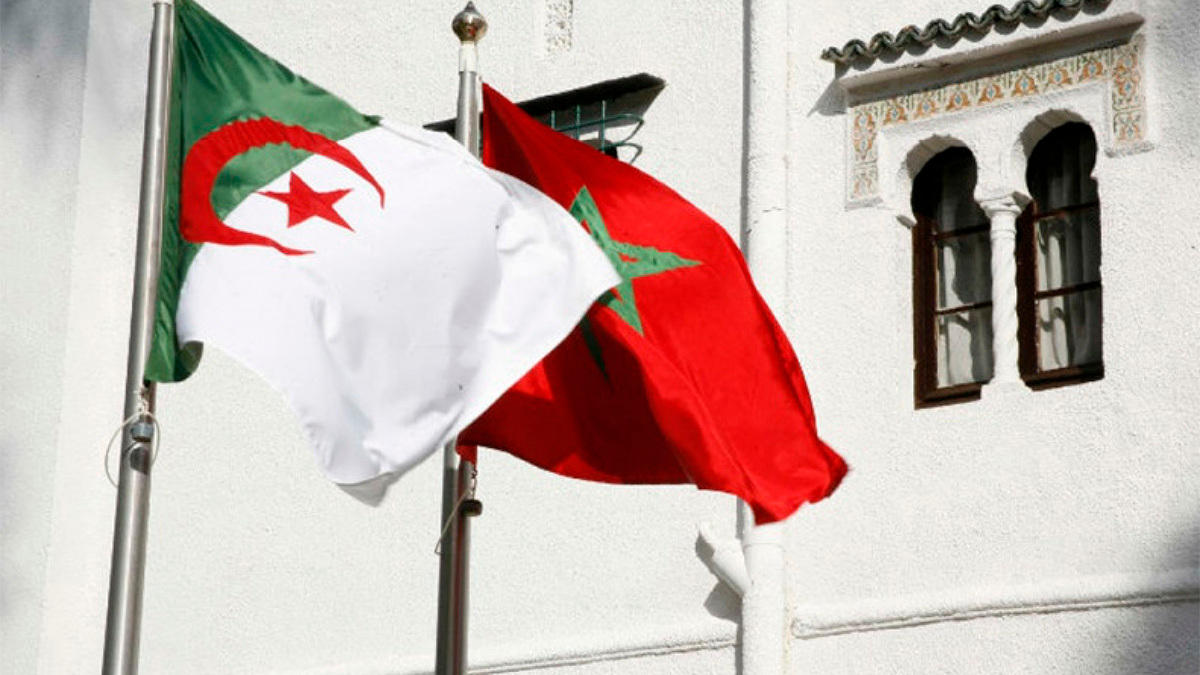

Morocco rises and Algeria falls in the 2025 Index of Economic Freedom

- The Moroccan economy, moderately free

- Structural challenges for the Moroccan economy

- The Algerian economy, ‘repressed’

Morocco has risen 15 places in the 2025 edition of the Index of Economic Freedom produced by the Heritage Foundation, ranking 86th out of 184 countries worldwide, with a score of 60.3. According to this classification, the Moroccan economy is considered ‘moderately free’.

The index takes into account a total of 12 factors that determine economic freedom and are grouped into four pillars: the rule of law; the size of government; regulatory efficiency; and open markets.

Compared to the 2024 edition of the Index of Economic Freedom, Morocco has increased its score by 3.5 points, while Algeria has advanced 3.6 points. Despite this, Algeria is ranked 160th out of 184, with a score of 47.5 and economic freedom classified as ‘repressed’.

The index data covers the period between July 2023 and June 2024, and is taken from sources such as the International Monetary Fund, the World Bank, the World Trade Organization, Freedom House and Transparency International.

The Moroccan economy, moderately free

Morocco's rise to 86th place in the world ranking has allowed it to jump from the rating of ‘mostly unfree’ that it held since 2022 to ‘moderately free’. An improvement that has confirmed Morocco's leadership in North Africa and at the regional level.

The country has thus moved up to sixth place on the African continent, behind Mauritius, Botswana, Cape Verde, the Seychelles and São Tomé and Príncipe. In the Arab world, Morocco also occupies sixth place, ahead of Kuwait and behind the other Gulf countries.

According to the Heritage Foundation, this progress has been possible thanks to the multiple reforms carried out by the Moroccan government, which have strengthened the competitiveness of the private sector, including:

- Simplification of the procedures for setting up and registering companies.

- Monetary stability, with a relatively controlled rate of inflation.

- Sustained growth and competitiveness of the Moroccan financial sector, which offers various financing tools.

- The opening up of the financial market: the Casablanca Stock Exchange does not impose any restrictions on foreign investors.

- Preferential trade agreements that attest to the opening up of international trade.

Structural challenges for the Moroccan economy

With a population of 37 million; a GDP (in terms of purchasing power parity, PPP) of 376.9 billion dollars; estimated growth of 3.4% in 2023; an average growth rate over three years of 4.4%, and 10,181 dollars per capita; an unemployment rate of 9.1%; inflation (CPI) of 6.1%; foreign direct investment of 2.1 billion dollars and public debt of 69.5% of GDP. Morocco has improved its economy, but it still has a long way to go.

Despite the progress, the Heritage Foundation has emphasised the persistence of structural weaknesses that require deeper reforms. These weaknesses include the following:

- A rigid labour market that holds back job growth and keeps a large part of the workforce in the informal sector.

- The very high cost of licences, despite efforts to simplify administrative procedures.

- Corruption amplified by insufficient regulation and an inefficient judicial system.

Although its ranking in the 2025 index has represented significant progress for Morocco, an effort is still needed to consolidate the country's achievements in terms of economic freedom.

The Algerian economy, ‘repressed’

In contrast to the increase in economic freedom in Morocco, Algeria occupies, according to the latest report from the Heritage Foundation, 160th place worldwide in terms of economic freedom, with a score of 47.5 and a rating of ‘repressed’, despite an increase of 3.6 points over last year.

Algeria occupies the third to last place out of 14 countries in the Middle East/North Africa region, with an economic freedom index below both the global and regional averages.

For the Heritage Foundation, the foundations of economic freedom are not well institutionalised in Morocco's eastern neighbour, due to the vulnerability of the judiciary, political interference and corruption, which hold back sustainable economic development. Despite some progress, fiscal governance still needs to be improved and the reforms carried out to diversify the economic base are not enough.

Despite the fact that Algeria is one of the world's leading exporters of natural gas, which, together with oil, accounts for almost 95% of export earnings and more than 30% of GDP, the country has not yet been able to improve its economy and advance in the Index of Economic Freedom.

With a population of 46 million; a GDP (PPP) of 777 billion dollars; a growth of 4.1% in 2023; an average growth rate over three years of 3.8%; 16,900 dollars per capita; an unemployment rate of 11.8%; inflation (CPI) of 9.3%; a total foreign direct investment estimated at 89 million dollars; and a public debt equivalent to 48.6% of GDP. Algeria must adopt measures and implement a series of structural reforms in order to face the challenges that are holding back its economic development:

- The weakness of the rule of law.

- The country's property rights, judicial efficiency and government integrity are below the world average.

- The highest personal income tax rate is 35%, and the highest corporate income tax rate is 26%.

- The tax burden is equivalent to 8.5% of GDP. Public spending and the average three-year budget balances are, respectively, 34.4% and -4.8% of GDP.

- Capital markets are underdeveloped.

- The financial sector continues to be dominated by public banks.

The report also emphasises that Algeria's general regulatory environment is relatively well institutionalised, but lacks efficiency, which means that the country's entrepreneurial, labour and monetary freedom is below the world average.

In terms of foreign investment, Algerian investors are in the minority and restrictions on foreign ownership continue to limit much-needed dynamic investment.