OCP achieves record revenues in the first half of the year

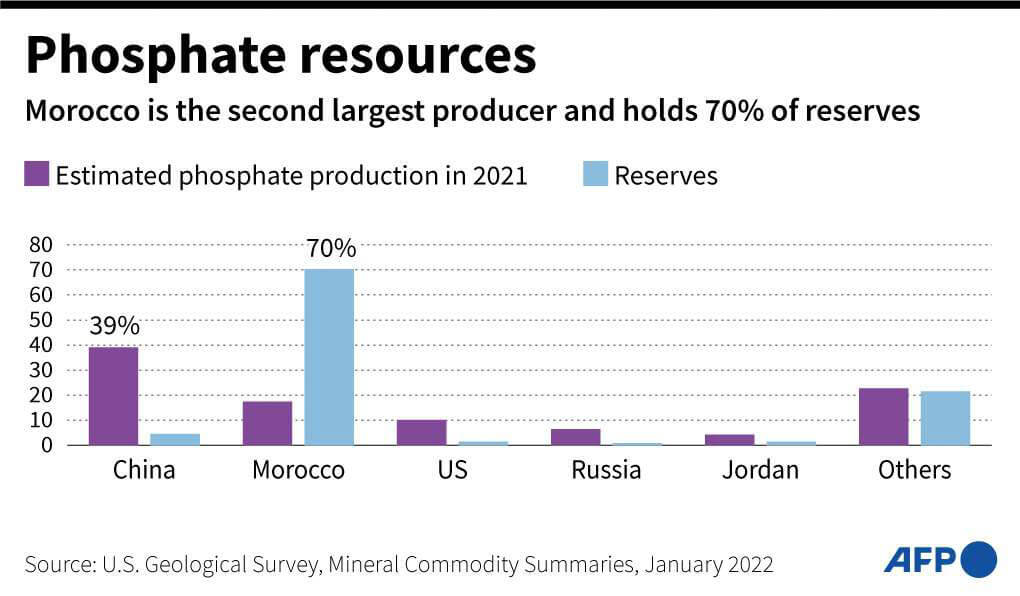

According to its latest report, the Moroccan state-owned phosphate company OCP has strengthened its position with respect to 2023. The world's leading phosphate company has shown its best performance thanks to strong Moroccan policy support and investment facilities; and strong demand in key global economic regions such as Europe and Asia.

The company's turnover brought revenues for the first half of 2024 to more than 43.2 billion dirhams, up 14% from last year; and a 38% profit margin, up 18% from the previous year.

EBITDA, short for earnings before interest, taxes, depreciation and amortisation, stood at 113% at 16.31 billion dirhams. This change is partly due to the large volume of rock, fertiliser and phosphoric acid exported despite falling prices.

This achievement impacted different market segments, with a 15 % increase in phosphate fertiliser sales in local currency due to high global demand, despite the price reduction compared to the previous year. Phosphoric acid also saw an 83% increase in turnover thanks to increased demand in India and Europe. Phosphate rock sales declined by 42%, however, increased exports to Europe and Asia offset this loss.

Operating profit increased significantly to 11.8 billion dirhams, compared to 2.42 billion dirhams in the previous year. At the end of June 2024, the company had 15.71 billion dirhams in cash and financial debts of 81.02 billion dirhams, resulting in a financial leverage ratio of 2.13x, down from 2.32x at the end of December 2023.

During the first half of 2024, OCP Group had a good financial performance with double-digit growth in its main indicators, in the words of its chairman and chief executive officer, Mostafa Terrab, in a press release.

Terrab said the group has leveraged its increased fertiliser production capacity to meet growing demand in several key markets, while improving the efficiency of its operations across its value chain.

He added: ‘In this context, OCP was able to leverage its industrial and commercial flexibility to deliver significant volumes of speciality products, such as Triple Super Phosphate (TSP), which rebounded by almost 50%, responding to increased demand in certain regions, in a timely manner‘. He also noted that ‘these assets, combined with our leadership position in cost control, strengthen OCP's competitiveness and maintain margins among the highest in the industry’.

Growth in the first half of the year was the result of several events. The first was the raising of more than $2 billion of bond investment in international markets. This amount was split in two. One part, 1.25 billion with coupons at 6.75% for 30 years; and 750 million with coupons at 7.5%.

This was the largest bond issue in the company's history. According to OCP sources, the confidence shown by multiple players in the international market was the reason for the company's decision.

The funds, according to the same source, will be used to finance the Green Energy Investment Programme until 2027. One of the objectives of this plan is to achieve the goal of becoming the world's leading supplier of phosphates and production of green ammonia. To this end, in addition to the bond issue, the OCP Group signed an agreement with the German bank KfW to receive financing of 200 million euros.

The aim is to improve global food security and combat climate change. The KfW loan is important for OCP's green investment strategy, which aims to increase sustainable fertiliser production between 2023 and 2027.

The Group will invest 150 million euros to use only non-conventional water in all its industrial operations by 2024 and will use the remaining 50 million euros to reach its clean energy and carbon neutrality targets.

In parallel, the company is tackling other projects that include using 100% clean energy by 2027, achieving carbon neutrality by 2030 and increasing the production of green fertilisers by 2040.

For these reasons, it started implementing the Mzinda Meskala strategic plan, which will serve to significantly improve capacity in two key areas. According to the report, production in the Mzinda-Safi Corridor is planned to increase to 12 million tonnes of rock, 3 million tonnes of phosphoric acid and 8.4 million tonnes of fertiliser by 2028.

By 2030, the Meskala-Essaouira Corridor is targeted to achieve an annual production of 20 million tonnes of rock, 1 million tonnes of phosphoric acid and 2 million tonnes of fertiliser. According to the Group, OCP Green Energy is making significant progress on the first phase of its solar energy project.

By 2024, this project will provide 202 megawatts of power to Khouribga and Benguerir. Currently, the work is almost complete, with 93% progress. Solar panels and trackers have been installed, the electrical substation has been built and construction work has been completed.