Saudi Arabia modifies its 2025 budgets due to falling oil prices

Saudi Arabia's revenues have been affected in recent years by the fall in crude oil prices on global markets and the Saudi government's decision to voluntarily reduce the country's oil production, although it continues to increase spending to promote growth and implement an economic transformation plan.

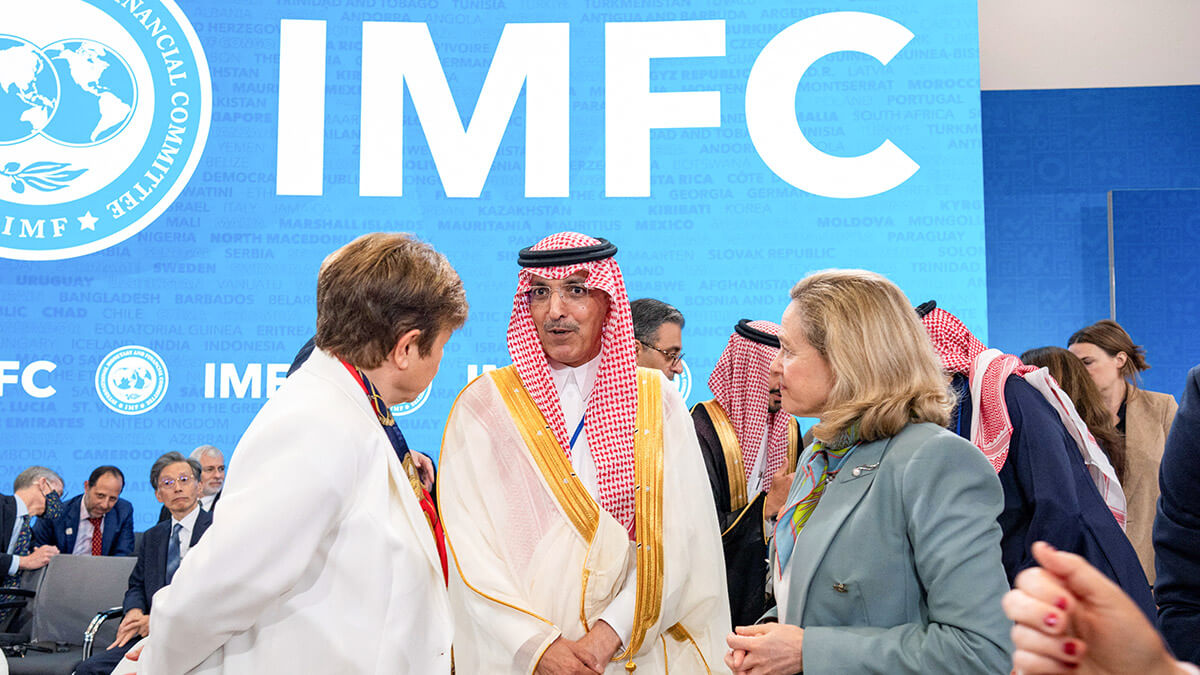

According to Mohammed Al-Jadaan, Saudi Arabia's Finance Minister, during the press conference to announce the new budgets, the fiscal deficit in 2025 will amount to approximately 2.3 % of Gross Domestic Product (GDP), which last year grew by 4.6 %. Moreover, the planned expenditure is in line with what was expected last September and will be approximately 30% of GDP over the next three years.

Mohammed Al-Jadaan also said at this press conference that ‘the budget for 2025 aims to continue to expand strategic spending on development projects in line with the sectoral strategies and Vision 2030 programmes’.

Spending, approved in the new budget, is expected to decrease to 1.23 trillion Saudi rials (equivalent to $342.7 billion), as authorities work to adapt to recent fluctuations in oil prices.

Vision 2030 to diversify the economy

To adapt to these falls, Saudi Arabia has already been working on projects such as Vision 2030, which seeks to diversify and strengthen the Saudi economy by developing sectors other than oil. One of these is the logistics sector, which is positioned as fundamental for economic diversification and GDP strengthening.

Saudi Arabia has made major investment and spending commitments to finance the Vision 2030 agenda in order to develop the economy away from oil. Monica Malik, the chief economist at Abu Dhabi Commercial Bank, stated that the government is looking to use all fiscal space to support the diversification agenda.

Prince Mohammed also stated that ‘the positive indicators of the economy are an extension of the ongoing reforms in the Kingdom in light of Vision 2030’. However, the Saudi Arabian government has started to cut back on some projects due to fluctuations in oil prices.

The oil market

Nevertheless, the Saudi finance minister declared that ‘financial solvency has the flexibility to withstand the fall in the level of crude oil’ and that the Saudi economy has reached a point where oil price volatility does not affect it as much as before. The difference, he said, is that spending expectations are being helped by oil revenues.

Aramco, in addition to oil, is a key pillar of the economy at the moment, as Saudi Arabia is the company's largest shareholder and it will be seen whether it continues to pay generous dividends at current levels.

In 2024, during the third quarter, the company maintained distributions to shareholders, even though profits had fallen. Currently, the Saudi Arabian government has no additional profit plan from Aramco, which funds many Vision 2030 projects.

Saudi Arabia, which is the largest Arab economy, needs a price of more than $98 per barrel of Brent, according to the International Monetary Fund, to break even. In addition, the finance minister expects public debt to reach about 30 per cent of GDP by 2025, up from 29.3 per cent last year.