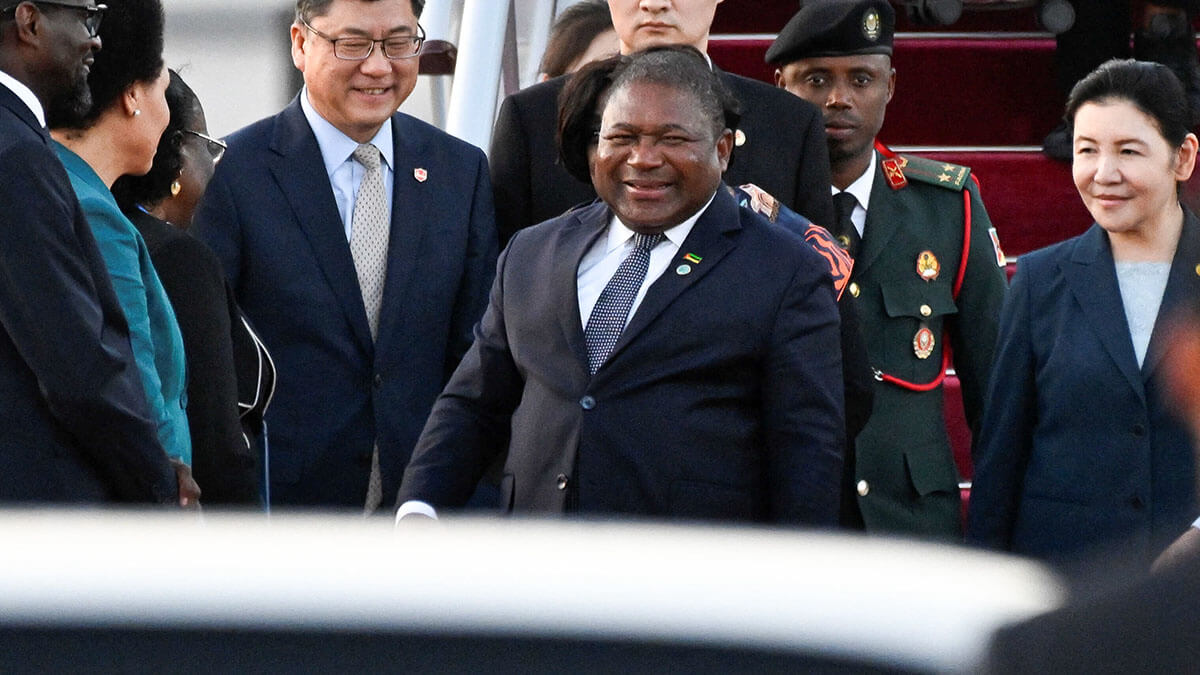

African leaders seek to boost Chinese investment in the continent

Numerous African leaders are travelling to China this week in a bid to secure funds to finance major infrastructure projects on the continent amid Beijing's growing influence in Africa.

Over the past decade, the Asian giant has sought to strengthen its relations with African nations, providing millions in loans that have boosted the continent's infrastructure. However, these actions have created controversy due to the huge debts the countries subsequently face. By strengthening these ties, China is also taking advantage of the continent's rich natural resources, such as copper, gold and lithium.

The China-Africa Forum, which will take place between 4 and 6 September in Beijing, is expected to be the largest diplomatic event of its kind since the coronavirus pandemic, with the participation of the leaders of the continent's major powers, such as South Africa, Nigeria and Kenya.

According to Chinese state media, China is already Africa's largest trading partner, with bilateral trade worth 167.8 billion dollars in the first half of this year.

For China, the African continent is a key focus of its Belt and Road Initiative, a huge infrastructure project and a key pillar of President Xi Jinping's plan to expand China's influence abroad.

This ambitious initiative has brought much-needed investment to African countries, such as rail projects, ports and hydropower plants. However, some accuse Beijing of indebting countries and financing infrastructure projects that damage the environment.

In this sense, one of the most controversial projects is the construction of a railway in Kenya valued at 5 billion dollars. This project, built with financing from China's Exim Bank, will link the capital, Nairobi, with the coastal city of Mombasa.

The modernisation of the railway line has reduced travel time from ten hours to four hours since it opened in 2017. It is the largest infrastructure project in Kenya since independence from Britain in 1963.

However, the second phase, which includes extending the line to Uganda, has yet to materialise, leaving both countries to pay off debts under the Belt and Road Initiative.

As a result, last year, Kenyan President William Ruto asked China for a billion-dollar loan and a restructuring of existing debts to complete other stalled Belt and Road Initiative projects. Kenya now owes China more than 8 billion dollars.

Central Africa's natural resources also attract China's interest. A region in Gabon alone contains up to a quarter of the world's known manganese reserves, according to AFP data. South Africa accounts for 37% of the world's manganese production.

The Democratic Republic of Congo dominates cobalt mining, accounting for 70% of the world's total. In terms of processing, however, China is the leader with 50%.

On the other hand, Africa is also affected by the growing geopolitical tensions between the United States and China, from the conflict over Taiwan to the trade war.

Regarding China's role in Africa, Washington has warned of its growing influence in a continent where other powers such as Russia and Turkey are also making strong inroads.

Ahead of the China-Africa Forum, Beijing has pledged to promote the continent's Belt and Road initiative. For the moment, China has already been responsible for important projects, such as the base and port in Djibouti, strategically located between the Red Sea and the Gulf of Aden.

According to China, this 590 million dollar project is aimed at supplying its ships, supporting regional peacekeeping operations and combating piracy. However, as AFP notes, its proximity to a US base has raised fears of espionage.

China has built Africa's longest suspension bridge in Mozambique through the national Road and Bridge Company. Before the construction of the three-kilometre bridge, ferries were the fastest means of transport, but overland it was a 160-kilometre journey over unpaved and flood-prone roads.

This bridge opened in 2018 and cost around 786 million dollars, 95 per cent of which was financed by loans provided by Chinese banks, most notably the Export-Import Bank of China.

China has also driven the growth of mines in southern Africa. In 2023 alone, China invested 7.8 billion dollars in mining, according to the Washington-based American Enterprise Institute for Public Policy Research. In the same year, state-owned MMG bought the Khoemakau copper mine in Botswana, one of the world's largest mines, for 1.9 billion dollars.

Separately, in July, a Chinese mining company acquired 80% of the debt-ridden Lubambi copper mine in Zambia for a nominal 2 dollars. Zambia announced that the company intends to invest 300 million dollars to restart work.

China has also invested in cobalt and lithium mines in Zambia, Namibia and Zimbabwe, and in mining ventures in South Kivu in the Democratic Republic of Congo.