BRICS and its new members

This is no longer a world in which the United States can set all the standards or manage all the institutions. Not to replace, but to create an alternative.

Introduction

"BRICS is the acronym denoting the emerging national economies of Brazil, Russia, India, China and South Africa. The term was originally coined in 2001 as "BRIC" by Goldman Sachs economist Jim O'Neill in his report, "Building Better Global Economic". At that time, the economies of Brazil, Russia, India and China experienced significant growth, raising concerns about their impact on the global economy. Foreign Ministers from these countries began meeting informally in 2006, leading to more formal annual summits from 2009 onwards 1.

BRICS members are prominent members of the United Nations (UN), the G20, the World Trade Organisation, the Non-Aligned Movement and the Group of 77, as well as continental and regional organisations such as the African Union (AU), the Southern African Development Community (SADC), the Common Market of the South (MERCOSUR), the Shanghai Cooperation Organisation (SCO), the Asia-Pacific Economic Cooperation (APEC), the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC), the Commonwealth of Independent States (CIS), the Collective Security Treaty Organisation (CSTO), the Eurasian Economic Union (EEU) and the Indian Ocean Rim Association (IORA).

Broadly speaking, these meetings are held to improve economic conditions within the BRICS countries and give their leaders the opportunity to work collaboratively on these efforts. In December 2010, South Africa joined the informal group and changed the acronym to BRICS. Together, these emerging markets represent 42% of the world's population and account for more than 31% of global GDP according to the World Factbook. According to the chairman of the 2023 summit, more than 40 nations were interested in joining the economic forum because of the benefits membership would provide, including funding for development and increased trade and investment. At the conclusion of the summit, it was announced that Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates will become new BRICS members from 2024.

What is the purpose of the BRICS group?

BRICS was created to find ways to reform international financial institutions such as the IMF and the World Bank, to give emerging economies a better voice and representation. In 2014, the BRICS created the $250 billion New Development Bank (NDB) to lend money to emerging countries for their development. Non-BRICS countries, such as Egypt and the United Arab Emirates, have joined the NDB.

Cooperation, development and influence in global affairs are at the heart of the BRICS' objectives.

These are some of the main objectives of the BRICS:

- Economic cooperation: fostering trade, cooperation and growth among members, as well as improving market access for BRICS economies.

- Development finance: create institutions such as CRAs 2 and NDBs to finance infrastructure and development projects in member countries.

- Policy coordination: strengthen policy discourse and coordination on international issues, including changing global governance institutions to reflect the changing global economic landscape and give emerging economies a stronger voice and representation.

- Social and Cultural Exchanges: promoting people-to-people relations and mutual respect for cultures while stimulating social and cultural exchanges between member countries.

- Technology and Innovation: to strengthen international collaboration in the areas of science, technology and innovation to promote knowledge sharing, capacity building and technological advances among member countries.

- Sustainable Development: promote sustainable and environmentally friendly methods of development as we work together to achieve the Sustainable Development Goals.

- Peace and security: promoting peace, stability and security at local and international levels, while addressing common security issues and risks, such as terrorism.

- South-South cooperation: strengthening cooperation and collaboration among developing countries, sharing best practices and supporting initiatives that contribute to the overall development of the South.

What are the objectives of this enlargement?

The real question, of course, is the objectives of enlargement. South African President Cyril Ramaphosa has highlighted the potential economic benefits. Indeed, we can assume that economic and financial cooperation between the eleven countries will increase, in particular thanks to the power of the investment capabilities of Saudi Arabia and the Emirates.

The underlying political objectives of this coalition are, on the other hand, less realistic. The decision to expand is a victory for Chinese President Xi Jinping, who was its most ardent supporter. However, if he intends to make the eleven BRICS members an instrument of his rivalry with the United States, he will face India and Brazil, which are not in the same dynamic. Likewise, if his idea, supported by Vladimir Putin, is to create a group of countries capable of opposing the G7, or the network of alliances formed by Western countries around or alongside the United States, he will struggle to find the same coherence between political regimes as different as those of Iran, South Africa, Brazil or China 3.

But the BRICS are not an international organisation, they have no permanent structures and have so far created only one common institution: a development bank. The heterogeneity of their members, who have different political systems and share neither a single market nor the production of common standards, complicates further study. This no doubt explains the silence, in Johannesburg, on de-dollarisation ambitions. Enlargement does offer the BRICS a better opportunity to exert influence on the world stage.

Which countries join the BRICS, what they bring to the table, analysis and motives

A group of five will soon be a concert of eleven, from BRICS to BRICS+.

BRICS is a "kind of anti-colonial reflex" to the economic domination of Europe and the United States (Patrick Heller) 4.

The greater the number of members, the smaller the common denominator, warns Indian analyst Raja Mohan 5. And Johannesburg is not Bandung (Indonesia), where the movement of non-aligned countries was born in 1955 with the aim of staying away from the two great rival blocs, the Americans and the Soviets. Stacking the BRICS is not enough to create a common home.

If economic weight is a measure of power, this will be a uniquely potent group. Together, the 11 BRICS states will have a larger share of global GDP based on purchasing power parity than the G-7 industrialised countries.

Iran, Argentina, Saudi Arabia, the United Arab Emirates, Egypt and Ethiopia: six countries that have been in the international spotlight this week. These nations, which wanted to join the "club of five" and which produce a quarter of the world's wealth, had their applications accepted on 24 August. They will officially join the economic coalition of Brazil, Russia, India, China and South Africa from 1 January 2024. It is a historic decision for a group that has not changed shape since 2011.

But its acceptance, issued at the last BRICS meeting in Johannesburg on 22-24 August, was not the only issue at stake at the summit. Another issue, which in the end was not clarified, dominated the discussions: the redefinition of the global monetary order and, in particular, the "de-dollarisation" of economies. In other words, the BRICS showed their determination to reduce their dependence on the US dollar and promote a new path. The idea, for its members, is to diversify international trade and strengthen their economic autonomy.

The criteria for admission were basically 3:

- to respect the balance between economic-authoritarian regimes and democratic countries, even if both economically and politically their democracies are imperfect 6.

- That there is indeed a geographical distribution and the entry of Arab and Muslim countries that were not included from the beginning is welcomed by this economic club that is the BRICS. (Not for nothing has Saudi Arabia taken a step forward. They can put billions on the table to finance development projects in the South).

- Willingness to move towards a de-dollarised multipolar economic order (towards a liberation from the dollar).

This approach has raised many questions, debates and positions on its feasibility and possible repercussions: how to create a more balanced and resilient financial system, what are the concrete options that would allow them to use their national currencies (for trade) and free themselves from the clutches of the greenback and the associated risks (exchange rate volatility, economic sanctions imposed by the United States, etc.). However, and this is undoubtedly the reason why the issue was not decided at the Johannesburg summit, a complete exit from the US dollar presents major challenges. Such an operation is complex, not least because of the dollar's dominant role in world markets and foreign exchange reserves. However, the economies of the BRICS countries are highly integrated into the world economy, and replacing the dollar as the reserve currency would require far-reaching reforms.

Redefining the global monetary order will not happen overnight. But thanks to the new entrants, six of the world's nine largest oil-producing countries are now part of the "new BRICS format". Oil is a resource that is traded... in dollars. The headache is not over 7.

To be clear, BRICS, or whatever it is now called, is far from being a unified group. It is not a formal international organisation, as the grouping does not even have a functioning website. Several of the nations, notably existing members China and India and new members Iran and Saudi Arabia, are and remain bitter geopolitical rivals, while others have deep economic challenges, from debt and inflation to slowing growth.

Moreover, with new members come new conflicts: Egypt and Ethiopia are fiercely at odds over the waters of the Nile, while Iran and Saudi Arabia are regional enemies, despite their Beijing-mediated attempt to make peace. These and other fault lines will make it much harder to turn the combined economic weight of the BRICS states into an influential political force in global affairs. Those who think of the BRICS as a new Non-Aligned Movement are unintentionally right in one respect: the BRICS may be as ineffective as the original in turning the growing rhetoric on global issues into concrete, practical results.

New member Argentina... New opportunities or dependencies for Buenos Aires?

The main advantage offered by the BRICS is the possibility of accessing credits from the New Development Bank (NDB), which is based in the Chinese city of Shanghai. This provides Argentina with a valuable alternative to loans from the Washington-based International Monetary Fund (IMF). The currency swap with China, in particular, seems to provoke euphoric enthusiasm in the Argentine government. "We should call ourselves Argenchina," said Economy Minister Sergio Massa during a visit to China two months ago, where he renewed the swap agreement. (A swap is a currency swap in which two countries exchange an amount in their respective currencies for a certain period of time. Argentina thus avoids having to pay for imports in dollars and pays for them directly in Chinese yuan).

"The currency swap with China gives Argentina a short-term respite, but it is not a solution to the real causes of the country's economic misery: galloping inflation and high public debt. Buenos Aires is trying to free itself from its dependence on the United States by increasing its dependence on another country.

The BRICS countries are partners of the New Development Bank (NBD), an entity created in 2015 and currently chaired by Dilma Rousseff. On its official website, it is defined as a multilateral space "that aims to mobilise resources for infrastructure and sustainable development projects in emerging markets and developing countries". Thus, Argentina's entry into the bloc would open up the possibility of accessing credits provided by the New Development Bank. This contingency fund for developing countries wants to replace the IMF to provide lighter loans and, if Argentina is there, it would help the country with the debt it owes to the Fund.

Let us not forget that the two main presidential candidates of the Argentine opposition for the October elections, Javier Milei and Patricia Bullrich, rejected on Thursday the announced entry of the South American country into the BRICS, a group made up of Brazil, Russia, India, China and South Africa. Javier Milei, who days ago promised to break off relations with China and Brazil, was categorical: "I don't make pacts with communists". The candidate of Juntos por el Cambio, Patricia Bullrich, made it clear that under her government "Argentina will not be in the BRICS". Everything is ready for Argentina to join the bloc formed by Brazil, Russia, India, China and South Africa on 1 January 2024, but in less than two months Argentina will elect a new president and the situation may be different at the beginning of the new year. Everything will depend on the new president.

BRICS expansion aims to overturn the Western-led order

Although South Africa's entry into the BRIC group in 2011 represents an enlargement of the organisation, the opening of the group to six new members is a first. Indeed, until the Johannesburg summit, the question of enlarging the group was widely debated. Although several countries have officially applied for membership in 2022 - a year marked by China's presidency of the BRICS - India, and to a lesser extent Brazil, had expressed their disagreement with opening the group to new members.

The BRICS now aspires to influence the international scene by embodying a platform for dialogue and cooperation among countries of the "global South" 8.

According to Reuters, more than 40 countries have expressed interest in joining BRICS. However, a smaller group of 16 countries have actually applied for membership, and this list includes Algeria, Cuba, Indonesia, Palestine and Vietnam. As the group grows in size, different views and priorities among its members could create tensions in the future. For example, India and China have had numerous border disputes in recent years, while Brazil's newly elected president has sought to "usher in a new era of relations" with the US.

What is certain, however, is that a new acronym for the group will soon be needed.

What role does Africa play and the effects of enlargement for the continent?

Following South Africa's accession in 2010, the African continent now has two new members in the BRICS group (Ethiopia and Egypt), which advocates a change in the world order characterised by Western economic dominance.

Why were these two African countries chosen, whose respective GDPs, as we know, are growing at high rates? This is the question asked by many observers, who recall that Nigeria, the leading economic power on the African continent, had its candidacy rejected despite being one of the countries knocking on the door of the BRICS. In any case, these three African countries, given their influence and the size of their economies, should play a leading role in defending the continent's interests.

And what about Algeria? Given the macroeconomic indicators of Egypt and Ethiopia, which will join the economic grouping on 1 January 2024, the Algerian candidacy had every chance of success.

For Anisse Terrai, investment banker and specialist in international relations at Harvard University, "the BRICS, especially China, had every interest in welcoming Algeria, since the new Silk Road passes through the North African giant, notably via the port of El Hamdania and the trans-Saharan route". Algeria's profile thus coincided in many respects with that sought by the five BRICS members. However, Algeria's economy remains heavily dependent on hydrocarbons (88% of its exports and 90% of its foreign exchange earnings), while Ethiopia and Egypt have much more diversified economies. This is perhaps one of the factors that weighed in the balance.

The planned inclusion of two more African countries - Egypt and Ethiopia - in the bloc has attracted much interest on the continent. "The BRICS-Africa partnership goes beyond convenience," said Djibouti's President Ismail Omar Guelleh, who chairs the Intergovernmental Authority on Development (IGAD), at the BRICS-Africa dialogue meeting in Johannesburg. "It is a step that puts Africa in its rightful position in the global order. Gideon Chitanga, a research associate at the African Centre for the Study of the United States at the University of the Witwatersrand, told DW that the inclusion of Egypt and Ethiopia would give Africa more of a voice in global issues. "You can see the deliberate effort to represent Africa regionally," Chitanga told DW. "South Africa is from southern Africa, and they [the BRICS] have added Ethiopia from east Africa and Egypt from north Africa," he said, adding that the move would represent African interests more broadly and inclusively.

Let's not forget and let's be realistic: Africa has major challenges ahead. Africa's impact on the global economy is yet to be felt, the remarkable economic performance as a whole has not led to a transformation that is capable of creating sufficient productive employment, and improving living conditions, as well as addressing the challenges of inequality. Africa's much-vaunted growth (always to be revised) has been and is highly vulnerable to commodity price volatility. "It is up to Africans themselves to change this trend and to take ownership and leadership of the transformation process”. 9

Can the BRICS bank replace the IMF as a lender?

The NDB is only at the beginning of its journey to create meaningful alternatives to the Bretton Woods institutions. According to analysts, by 2026 the NDB will expand its total package of approved loans to $60 billion: such ambitious forecasts among experts indicate that the Bank is on the right track. The purpose of this path is the overall mission of the NDB: to increase the developed world's confidence in developing countries in the global economy and a clear demonstration that emerging markets are becoming a real force to be reckoned with.

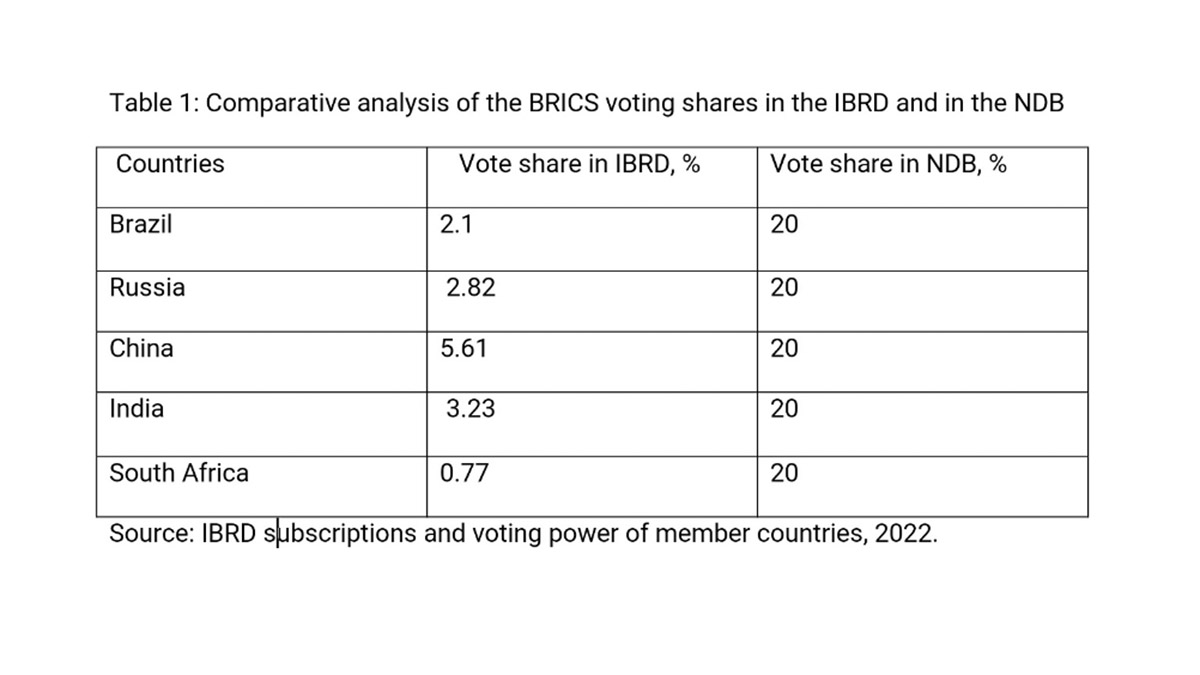

The main catalyst for the creation of the NDB was the shift towards emerging market countries within existing international financial institutions (see Box 1). Negligible voting shares among developing world representatives in international economic organisations sidelined the hopes of BRICS member states to build a global financial architecture within the Bretton Woods institutions, regardless of the country's political landscape and economic potential. Indeed, the lack of opportunities for developing countries to have a real impact on the key decision-making process reduces their participation in international organisations to a zero-sum game: in any case, the opposing side would be in a winning position.

Is this the end of globalisation?

The incorporation of several African countries or Argentina shakes up the chessboard in areas normally controlled by the United States, Europe and their supranational institutions such as the IMF.

There are now alternatives, which, although they will not replace the international organisations that have been the only option since the 1990s, such as the G7, will offer some countries a new alternative.

Realities. A largely dysfunctional organisation gains neither quality nor influence simply by attracting more members. A rift is currently emerging within the BRICS. On the one hand, there are three imperfect democracies - South Africa, India and Brazil - that seek to maintain strong relations with Western donors. On the other hand, the BRICS include two autocratic allies, China and Russia. All members share the goal of limiting US hegemony. However, some countries, such as India, do not see things the same way. Increasingly seeing itself as a rival to China, it is not keen on the idea of enlarging the BRICS.

It is not entirely clear what the new BRICS members stand to gain from membership of the bloc. For the moment, at least, this step is more symbolic than anything else: it is an indication of broad support in the global south for a reorganisation of the global order. Vladimir Putin did not attend the three-day summit in person, as he faces an arrest warrant for war crimes in Ukraine issued by the International Criminal Court, but the BRICS enlargement represents a symbolic boost for him as he fights a US-led effort to isolate his regime and force a withdrawal and an end to the war.

The decision to admit Iran, which was also seeking a way around sanctions, represented a victory for Putin and Xi, helping to give the group a more anti-Western and undemocratic tinge. They overcame the more cautious approach of the other members, who prefer to present the group as non-aligned.

Trade will not be established by the rules of full free trade as it has been established so far, but by trade relations by countries belonging to a geographical area or domain.

Conclusion

This extension of the initial format had to happen. Let us say that it was inevitable; the countries that are and will be part of this multinational organisation will be served in their initiatives and demands under a different umbrella and closer to their interests.

Some of them are major economies and their geopolitical origins are strategic, as is their influence on the world map. They come from culturally and politically distinct geographies and certainly represent an alternative to Western standards. It remains to be seen, however, how far they will go and what real influence they may have in such fields as trade, natural resources, demographics, politics, geostrategic decisions, and even military influence.

REFERENCES

1- 1st BRICS Summit - Joint External Declaration

16 June 2009 in Ekaterinburg, Russia

2nd BRICS Summit - Joint Declaration External

16 April 2010 in Brasilia, Brazil

3rd BRICS Summit - Declaration of Sanya External

14 April 2011 in Sanya, China

4th BRICS Summit - Declaration of Delhi External

29 March 2012 in India, New Delhi

5th BRICS Summit - Declaration eThekwini External

26-27 March 2013 in Durban, South Africa

6th BRICS Summit - Declaration of Strengthening External

July 14-16, 2014 in Fortaleza, Brazil External

7th BRICS Summit - Ufa Declaration External

July 8-9, 2015 in Ufa, Russia External

8th BRICS Summit - Goa Declaration External

October 15-16, 2016 in Goa, India

9th BRICS Summit - Xiamen Declaration External

September 3-5, 2017 in Xiamen, China External

10th BRICS Summit - Johannesburg Declaration External

Johannesburg, South Africa, 26 July 2018

11th BRICS Summit - Brasilia Declaration External

Brasilia, Brazil, 14 November 2019

12th BRICS Summit - Moscow Declaration External

November 17, 2020 Moscow, Russia External (held virtually)

2- The BRICS Contingent Reserve Arrangement is a framework for the provision of support through liquidity and precautionary instruments in response to actual or potential short-term balance of payments pressures. It was established in 2015 by the BRICS countries: Brazil, Russia, India, China and South Africa.

3- Le Monde 26 August 2023.

4- Patrick Heller is an American sociologist and director of the development research programme at Brown University's Watson Institute for International and Public Affairs.

5- Chilamkuri Raja Mohan is an Indian academic, journalist and foreign policy analyst. He is the director of the Institute of South Asian Studies, National University of Singapore. Previously, he was the founding director of Carnegie India.

6- The starting balance of this group was "remarkable". On the one hand, Russia and China, with a totalitarian and authoritarian system emphasising economic development; on the other, India and Brazil, two democracies with a market economy.

7- Jeune Afrique. 22 August 2023. Yara Rizk

8- This term is widely criticised in the West for its political connotations, but is widely used by the BRICS countries, and China in particular, to describe the traditionally "non-aligned" "emerging countries".

9- Carlos Lopes. Structural Change in Africa. Catarata Editions