Morocco-Nigeria Gas Pipeline, the promise of Africa

A project that not only promises to boost African economies, but also leads to the promotion of the integration of the continent and progress in the interdependence of gas. This is, in fact, the gas pipeline between Morocco and Nigeria.

- Dimensions of the gas pipeline

- The countries involved

- 2024, the key year

- Interests in the development of the project

- Europe's energy partners

- Possible branch line in Cadiz

- Who puts up the money?

- Threats and challenges

- Algeria, Morocco competition

Dimensions of the gas pipeline

Under the premise of "everyone wins”, progress continues on what will be the longest underwater pipeline in the world. Its capacity will be approximately 30,000 million cubic meters and its length will be around 6,000 kilometers. It will travel about 5,600 kilometers by sea, to which another 1,700 kilometers by land will be added. The cost will be around 25,000 million euros.

The countries involved

The objective for which the pipeline is wanted to be created is for the economy of the West African nations to register a positive and noticeable impact.

With the initiative, new jobs will be opened and the quality of life in the participating places will increase, so there will also be improvements at the social level. For that reason, since the plan was announced in 2016, several countries have joined the initiative.

To date, the sum of countries that have wanted the infrastructure to cross their territories on its way through Africa is 13 participants: Nigeria, Benin, Togo, Ghana, Ivory Coast, Liberia, Sierra Leone, Guinea, Guinea Bissau, Gambia, Senegal, Mauritania and Morocco.

2024, the key year

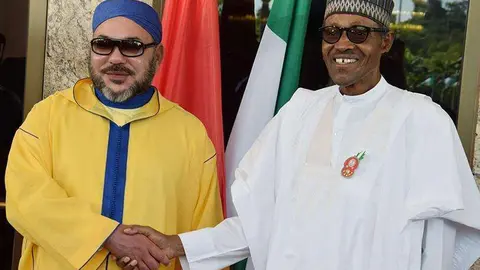

Since it was proposed, the project has always been very attractive. However, it was not until 2016 when the Moroccan National Office of Hydrocarbons and Mines (ONHYM) and the Nigerian National Petroleum Corporation (NNPC) defined the initiative.

2024 is a crucial year in the progress of the proposal, since it is when the most important phases will be ensured: the signing of the required intergovernmental agreements, the creation of an entity in charge of monitoring and directing the operations and the assurance of the memorandums of understanding signed by the ONHYM.

As Laila Ben Ali, the Moroccan Minister of Energy Transition, has already said, progress is being made “by leaps and bounds."

Interests in the development of the project

Nigeria is in a very favorable position. It has a considerable surplus of natural gas. Its reserves reach 209 trillion cubic feet. Its production has recently reached 1.7 million barrels per day and it is now working to build new infrastructures and main natural gas lines within its borders. Also, the Minister of State for Petroleum Resources of Nigeria, Ekperekebe Ekpo, has assured that, once the pipeline is operational, his country will maintain the uninterrupted flow of supplies.

In this context, it intends to transfer the surplus of natural gas to African countries where the population does not have access to energy supply (prioritizing those who will participate in the gas pipeline plan). It also wants to supply the gas to Mali, Niger and Burkina Faso, three member countries of the West African Economic Community (ECOWAS).

Morocco, on the other hand, assured that this alliance of Afro-Atlantic countries led by Rabat, had positive consequences in economic and social terms, but, in addition, it would lead to an integration of the countries of the region that would make the area a strong and more powerful place.

The future energy sector of the countries related to this initiative seems to be leading to a flourishing future and the regional economies to significant growth. Hence the great interest of African countries to get involved in the development of the project.

Europe's energy partners

The gas pipeline opens up a new energy option for the countries of Europe.

Since the outbreak of the armed conflict in Ukraine, the members of the European Union have diversified the energy mix through renewable energies and supply agreements with other states.

This situation is very interesting for West Africa. With their project, Morocco and Nigeria open a new gas market in the African region, with which the possibility of becoming a gas transportation hub to Europe is not remote.

Possible branch line in Cadiz

Spain knows firsthand the uncertainty of Algerian gas. Having Morocco as the main energy partner to supply Nigerian gas would make greater security possible for the Iberian country.

A possible extension of the tube to Cadiz has been put on the table. This would open the door to national connections, through which gas could continue to be transported. Even by using Spanish liquefied natural gas plants, Nigerian gas could be distributed throughout the European continent.

The relationship between Spain and Morocco is stable. It is true that they have faced cyclical crises (such as the one in Western Sahara), but the interest is reciprocal and maintained over time.

The export of gas from Africa would strengthen the ties between the two actors. This would make it easier to make joint decisions, not only in relation to the energy sector, but also on important issues for Spain and Morocco, such as immigration or military cooperation.

But Nigeria also enters into this equation, which in turn would experience a rapprochement with Spain. The quantities of Nigerian oil and natural gas that now reach Spanish soil are enormous. Thus, increasing exports in the current context is very attractive. On the other hand, Nigeria is interested in the security and assistance in the prevention of terrorism that it would obtain with the Spanish international collaboration.

Who puts up the money?

The pipeline is a priority for Morocco and Nigeria. Therefore, both are interested in streamlining the processes. The planning stage has already been defined. We have to keep moving forward... but for that, we need money.

With a statement from the Islamic Development Bank (IDB), in which it announced that it would finance the NNPC to materialize the construction processes of the pipeline, the principle of the plan was ensured. Specifically, based on an agreement signed between the first entity, the Ministry of Economy and Finance and ONHYM, the IDB was responsible for contributing a figure of more than 90 million euros to support the planning phase.

The Organization of the Petroleum Exporting Countries (OPEC) has also contributed financially to the preliminary studies, with aid of 14.3 million euros.

The IDB even announced its willingness to transfer a part of the revenues to payments under the prospecting contracts (whether offshore or onshore) of the southern zone between Nigeria and Senegal.

Recently, the ONHYM has confirmed that it will be responsible for creating a company with which to monitor the financing and lifting of the tube.

The ONHYM, together with NNPC, will finance the project by injecting, each of the parties, half of the 25,000 million euros amount.

On March 20, Mele Kyari, president of the NNPC, the state oil company in Nigeria, took advantage of the CERAWeek, an annual energy conference held in Houston, to ensure that the necessary financing will be obtained in December to launch the Moroccan-Nigerian megaproject on the ground.

Threats and challenges

This is a megaproject, so the difficulties you will have to face will also be of great dimensions.

The first point against is insecurity. Some of the countries involved have transitional political regimes. These are the coup-making nations of Mali, Chad, Burkina Faso and Niger. Their political situation is one of instability. Therefore, it is difficult for them to ensure reliable and permanent national security.

This is compounded by terrorist activity. ISIS and Al-Qaeda on the Sahelo-Saharan side and the Boko Haram group in Niger, are a direct threat. The pipeline could be a target for terrorist organizations, so the implementation of the project and its protection could be seriously affected.

On the other hand, the fact that there are 13 member countries is another challenge. The reason is that the higher the number of participants, the greater the risk of trade and economic conflicts arising between them. Some territories are struggling to provide the funding they are due. That is why, when it comes to implementing the pipeline and getting natural gas, it will not be possible for certain countries to meet their economic obligations.

But this is not all. There are also environmental risks, as the infrastructure will pass along the coasts of the Atlantic Ocean. The strategies and agreements on maritime security make this initiative a sensitive issue. In the case of damaging environmental resources or the life of aquatic fauna and flora, organizations responsible for the conservation of this environment, as well as environmental activists, could prevent the development of the gas pipeline.

Algeria, Morocco competition

In August 2021, Algiers broke off diplomatic relations with Rabat and stopped the shipment of gas to Spain via Morocco. They were separated by an obvious tension.

Gas is an urgent issue for Morocco and Algeria can boast of having had a privileged position in relation to Europe. Such is the case that, in 2023, Algeria was the second gas supplier country to Europe and the first African country in the export of liquefied natural gas (LNG), surpassing Nigeria.

The uncertainty regarding the Algerian attitude towards the gas pipeline raises the interest in the project.

If the joint objectives between Morocco and Nigeria are met, the new pipeline will be able to compete directly against Algerian gas.