Renewable energies, technology and services, the keys to economic growth in North African and Middle Eastern countries

The region of North Africa and the Middle East, known by the acronym MENA, has been experiencing significant economic growth in recent years, as the countries that comprise it are diversifying their economies with respect to income from energy resources such as oil and gas.

By 2025, the GDP of these countries is estimated to grow by 2.2% on average, in particular due to the rise of renewable energy, technology and the service sector, while energy subsidies are being phased out.

This is a very favourable scenario for Spanish companies to take advantage of the opportunity to do business in a large area with a promising future. That is why the Official Chamber of Commerce, Industry and Services of Madrid wanted to provide interested entrepreneurs with information on one of the fundamental tools for internationalisation: financing.

Aresbank

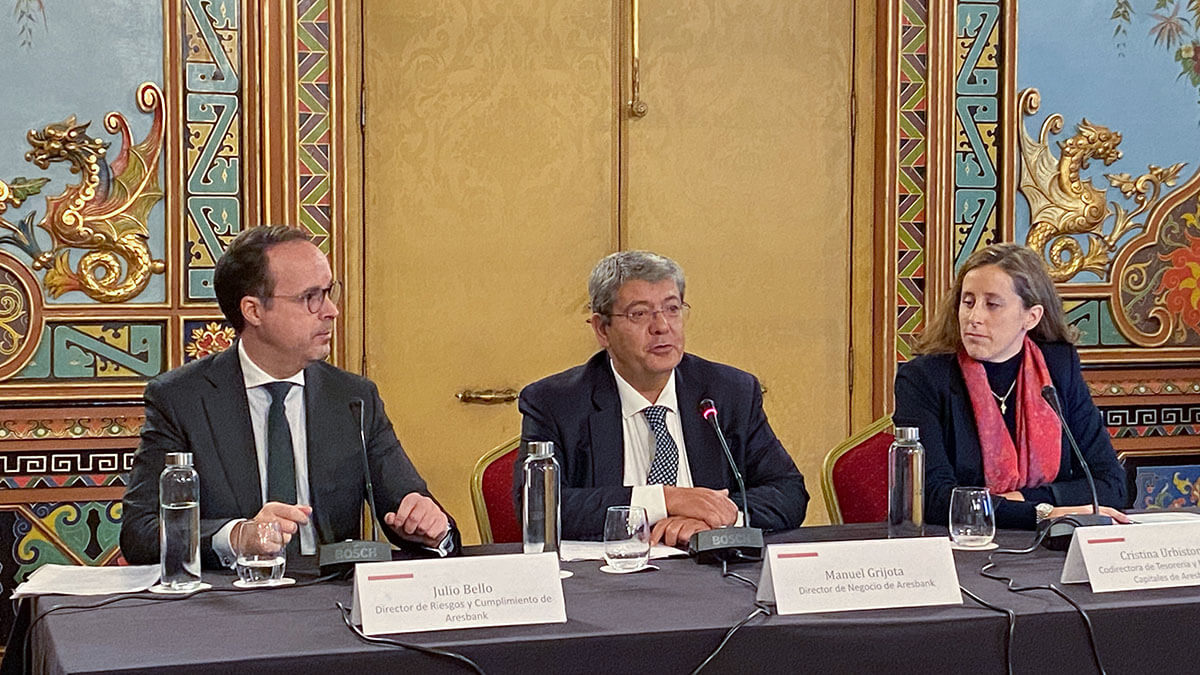

The conference held on 5 November at the Palacio de Santoña in Madrid served to remind Spanish companies that there is a Spanish entity, Aresbank, which is a leader in the management of financial and foreign trade operations in the MENA region.

As its CEO, Javier Sierra, pointed out , ‘Aresbank is a great unknown, but in its business it is as good as the best in Europe. We are a niche bank, which offers a differential value to our clients’.

The Aresbank executive highlighted the four features that make the bank special: it has a clear shareholder, the Libyan Foreign Bank, which makes strategy and decisions quick and clear; it operates in an area of the world where it is very good and can add value; it has excellent products for foreign trade; and it has a great team, with experience, commitment and personalised service.

Despite having the Libyan Foreign Bank as majority shareholder, Aresbank is an entity with a banking record in Spain, supervised by the Bank of Spain, member of the Chamber of Commerce and partner of the ICO.

As for its clientele, Sierra pointed out that they are leading companies in their sector that want to internationalise.

Documentary credits

For his part, the entity's business director, Manuel Grijota, explained that ‘the countries of the MENA region export oil, gas, derivatives of these and agricultural products, while Spain exports industrial products, civil works and consumer products’.

It is in this scenario of exchange that the importance of a financial product such as documentary credits arises , which are one of the main tools with which the bank works.

The documentary credit is a payment mandate that the importer sends through his financial institution to pay the exporter the amount of the operation. The exporter, for his part, must comply with the conditions established by the financial entity that grants the credit.

According to Grijota, this is the safest method, because the whole operation is carried out through the bank, the importer is sure that the products will reach him, and the exporter knows that he will receive the amount of the sale.

In addition to documentary credits, and like any other Spanish bank, Aresbank also offers loans, credit accounts, factoring, confirming...

Foreign exchange risk

An important issue when it comes to foreign trade operations is the inherent foreign exchange risk that occurs when a businessman sells his products in another country. In this respect, Cristina Urbistondo, co-director of Treasury and Capital Markets, pointed out the importance of dollar transactions in the MENA region, which her institution manages through its correspondent, the US bank JPMorgan.

In the same way, Aresbank also carries out currency trading operations, in an agile and competitive way, avoiding its clients the risk derived from the volatility of exchange rates.

Julio Bello, Aresbank's Director of Risk and Compliance, insisted that the institution is subject to constant supervision by the Bank of Spain, thanks to which it can boast ‘a lower credit risk profile than other institutions and a level of default close to zero, with a coverage ratio of over 70 %’.

Algeria

Its clients include major Spanish companies such as Acciona, Amadeus, Técnicas Reunidas and Network Steel, and it operates with a multitude of countries, including some with which Spain's diplomatic relations are going through difficult times, such as Algeria.

In this sense, Manuel Grijota stressed that ‘we can receive documentary credits from Algeria; another thing is that Algerian banks currently have a regulation that prohibits them from operating with Spanish banks, with a few exceptions such as operations involving food products or livestock. But everything points to the fact that these commercial relations between Spain and Algeria are going to be re-established, as both governments are working on it’.

The entity's director general, Javier Sierra, went further: ‘there is an important project involving a Spanish company that will be announced next week’.

Regarding the cultural differences between Arab countries and Spain when it comes to doing business, Aresbank executives were unanimous: "the Arab world appreciates the Spanish business community, because they know that we are serious people. They feel close to us, as seven centuries of coexistence are noticeable. If you go with serious projects and contact the right people, there is a good chance that they will go ahead. We Arabs and Spaniards understand each other very well and we are delighted to do business together,’ Grijota concluded.