Investing in Morocco

- Why is this investment important?

- Proposal for the creation of a support mechanism for MDMs and foreign investors

- Organisational structure of the Agency

- Governance and accountability

- Conclusion

‘The twelve labours of Hercules’ Have you heard of them?

That is what MDM (Moroccans of the World) investors face: a series of very arduous, time-consuming, or particularly restrictive tasks.

They face a series of insurmountable challenges, requiring great physical, mental, organisational, and even financial effort. All this in a short space of time, leaving their work in progress in the host country.

They are sent from one window to another, from one administration to another, without ever finding their way easily. They surround themselves with unscrupulous people who promise them the moon, and in the end, they leave with empty hands and a huge budget, without achieving any actual results.

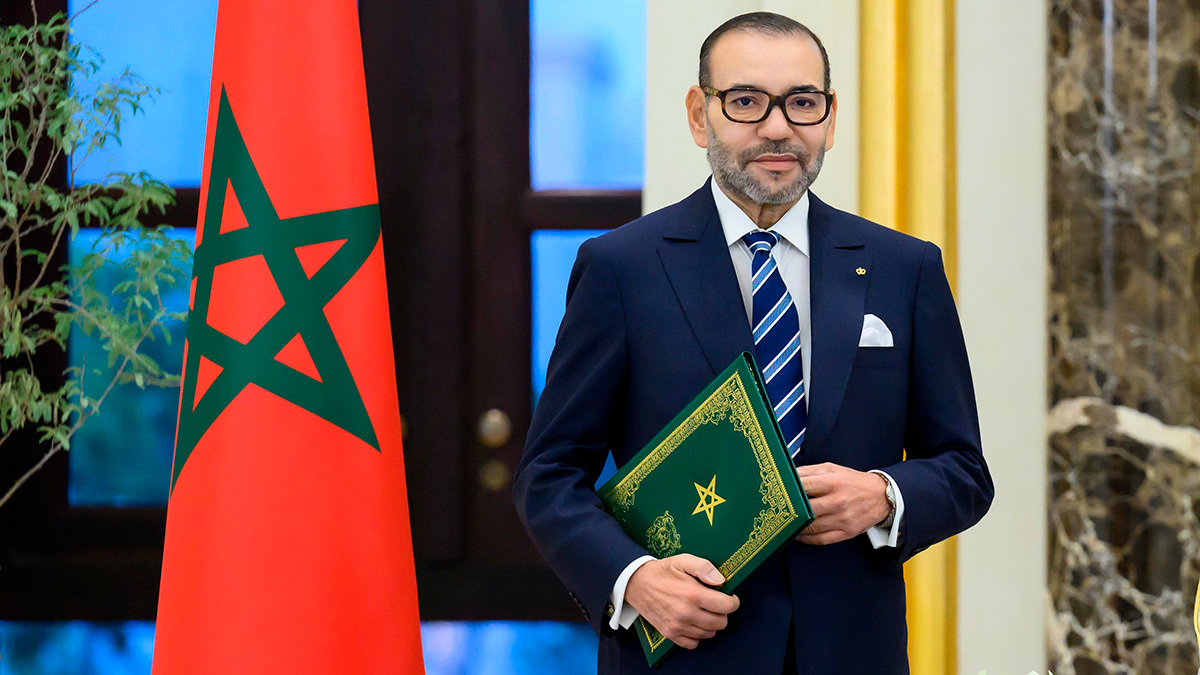

There is no denying the enormous efforts that our country has made in recent years, under the leadership of His Majesty King Mohammed VI, may God protect him, to make investment accessible to all, in all areas and at all levels, but what is really happening? It seems to me that the institutions that have been set up to deal with investments by MDMs and even foreign companies overlook some minute details. I am talking about small and medium-sized enterprises.

Why is this investment important?

- Support for job creation: MDM investments in SMEs create thousands of direct and indirect jobs, especially in Morocco's less developed regions.

- Economic diversification: MDMs contribute to the diversification of the Moroccan economy by supporting sectors such as agriculture, services, industry, and digital technology.

- Knowledge and technology transfer: MDMs also provide knowledge, an international network and invaluable expertise for the growth of Moroccan SMEs.

MDMs play a key role in the Moroccan economy and, although the exact proportion of their investments in SMEs varies, it is estimated that their contribution to this sector is not negligible, with a direct impact on the employment and competitiveness of Moroccan companies. But that is not enough, it needs to be further enhanced!

Proposal for the creation of a support mechanism for MDMs and foreign investors

To this end, it is proposed to create a support module dedicated to facilitating administrative procedures, advising MDMs and foreign investors interested in promoting investment opportunities in Morocco on a global scale.

The envisaged entity would be established in the 12 regions (soon to be nine) of Morocco with a new multilingual information and exchange platform, offering accurate data, a dynamic community, advanced analytical tools, and full customisation to meet all their investment needs.

Barriers to investment in Morocco

Despite the country's strengths, there are several challenges that can hinder Morocco's attractiveness to investors:

- Administrative complexity: bureaucratic procedures are often perceived as slow and complicated, which increases costs and delays for investment projects.

- Corruption: corrupt practices exist in certain administrative spheres, creating a climate of distrust and risk for investors.

- Legal and regulatory restrictions: strict laws in certain sectors limit investors' flexibility, making it difficult to implement certain projects.

- Linguistic and cultural barriers: for foreign investors, cultural and linguistic differences make it difficult to navigate the Moroccan market and establish solid partnerships.

Creation of an investment support agency

Faced with these challenges, it is essential to create an agency specialised in investor support. The aim of such an agency would be to simplify administrative procedures, fight corruption, harmonise legal frameworks and ensure coordination with government bodies.

The benefits of such an agency are manifold:

- Reducing operational time and costs: by streamlining procedures and centralising administrative formalities, the agency would provide a one-stop shop to reduce costs and speed up investment projects.

- Increasing transparency and trust: by establishing control mechanisms and actively fighting corruption, the agency would strengthen the credibility of the Moroccan market for foreign and domestic investors.

- Encourage innovation and economic diversification: the agency would foster an environment conducive to innovation and diversification in the country's economic sectors, while supporting job creation and sustainable development.

Role of the agency in investor support

The investment support agency would have several key missions:

- Welcoming and guiding investors: it would constitute a first point of contact for investors, guiding them through the stages of investment, answering their questions and directing them to regional agencies for detailed follow-up.

- Simplification of administrative procedures: by centralising administrative procedures and offering personalised support, the agency would reduce the complexity and costs associated with bureaucratic procedures.

- Strategic advice and ongoing assistance: the agency would offer advice on the best investment opportunities, available tax incentives and provide support for project implementation, including fundraising and partnership management.

- Anti-corruption and improved transparency: by adopting lofty standards of governance and setting up monitoring mechanisms, the agency would help reduce corrupt practices and increase investor confidence.

- Monitoring and oversight: the agency would monitor investment projects, evaluate their performance and report regularly on progress, thus ensuring the sustainability of projects.

Organisational structure of the Agency

The agency would be managed by an overall agency, which would oversee twelve regional agencies, soon to be nine, spread across the country.

In addition, an online communication platform accessible through social media (such as Facebook, Instagram, and YouTube) would be used to disseminate information internationally. Investors would be able to obtain information on investment opportunities and contact the general agency, which would direct them to regional agencies according to the type of project.

The regional agencies would be responsible for providing personalised support to investors, facilitating administrative procedures, analysing projects, and guiding them to the appropriate funding.

Governance and accountability

The agency would be under the direct supervision of His Majesty the King to ensure efficient and transparent management.

The Director General would be responsible for the day-to-day management of the agency, while a Board of Directors composed of representatives of the government, the private sector and independent experts would set the strategic direction. Regular internal and external audits would monitor the agency's management, enhancing transparency and accountability.

Conclusion

The creation of a dedicated agency to support MDMs and foreign investors is a strategic initiative to increase Morocco's attractiveness as an investment destination.

By simplifying administrative procedures and offering personalised support, this agency would contribute to the country's economic dynamism. With a solid organisational structure and direct support from senior management, the agency could promote Morocco as a secure and innovative investment hub, capable of attracting capital and creating new opportunities for employment and economic growth.